If you’ve ever wasted half your morning copying IPO data from multiple sources into a spreadsheet—only to second-guess its accuracy later—you know that the manual grind drains your energy and jeopardizes the quality of your analysis. The most reliable methods rely on financial APIs, advanced Excel add-ins, and smart web-based data retrieval techniques that bring IPO data straight into your spreadsheet—accurately and automatically. Learning how to get IPO data into Excel will help you streamline your financial analysis and automate tedious tasks.

Key Takeaways

- Automation cuts down on entry errors and saves valuable time.

- APIs and Excel add-ins deliver real-time IPO data for deeper insights.

- Smart automation frees analysts to concentrate on interpretation and decisions.

Best Methods on How to Get IPO Data Into Excel

Modern finance professionals need to work with speed and precision. Bringing IPO data into Excel now relies on a blend of automation tools that connect directly to the most reliable financial data sources. By eliminating manual data entry, you reduce errors, speed up the analytical process, and improve overall productivity. This is crucial for effective financial analysis in Excel.

Utilizing APIs For Real-Time Data

APIs from major data providers like Daloopa plug directly into Excel workflows, offering live access to critical IPO-related metrics such as pricing, filing details, and historical performance. These APIs empower you to fetch data with built-in Excel functions like =WEBSERVICE(), ensuring that your data is always up-to-date. By learning how to get IPO data into Excel, you can easily set up automated systems that stay current without the need for constant manual updates.

Excel’s Power Query tool further refines the raw output from these APIs by cleaning, shaping, and organizing it into structured tables. With Power Query, you set automated refresh schedules so that your IPO tracking sheet updates as soon as new data becomes available—ideal for capturing the dynamic nature of the market. The combination of APIs and Power Query will help you automate financial data in Excel and keep your analysis accurate.

Effective API Integration Steps:

- Set Up Authentication: Register for API access and secure your unique access keys.

- Build Dynamic URLs: Create URLs that adjust based on your needed data, such as specific stock tickers or IPO dates.

- Map Data Fields: Convert JSON data into Excel-readable formats by mapping fields to appropriate cells.

- Configure Auto-Refresh: Define refresh intervals to keep your data live and reliable.

Leveraging VBA For Custom Data Automation

Excel’s powerful VBA (Visual Basic for Applications) engine can customize your data import processes for scenarios where standard functions and add-ins fall short. With VBA, you write scripts that automatically pull data from online sources like the SEC’s EDGAR database (SEC EDGAR) or even directly scrape web pages for emerging IPO filings. This method helps you automate financial data in Excel without relying on third-party add-ins.

VBA automation empowers you to create custom workflows tailored to your specific research needs. Whether you’re building macros that refresh data every morning before the market opens or setting up interactive forms to filter IPO data by sector, VBA offers the flexibility and control that many analysts require.

Key VBA Elements to Consider:

- Error Handling: Implement robust error-checking routines to manage unexpected issues.

- Data Validation: Ensure incoming data meets your quality standards before it enters your main workbook.

- Auto-Formatting: Program the formatting of data to match your established templates.

- User Controls: Develop interactive buttons or forms that allow for one-click data refreshes.

Incorporating Third-Party Add-Ins

When time is of the essence, third-party Excel add-ins from trusted financial platforms can deliver curated IPO data directly into your workbook. These tools come with built-in formulas, templates, and data validation checks explicitly designed for financial analysis in Excel, making them a favorite among investment professionals.

Top Add-Ins to Consider:

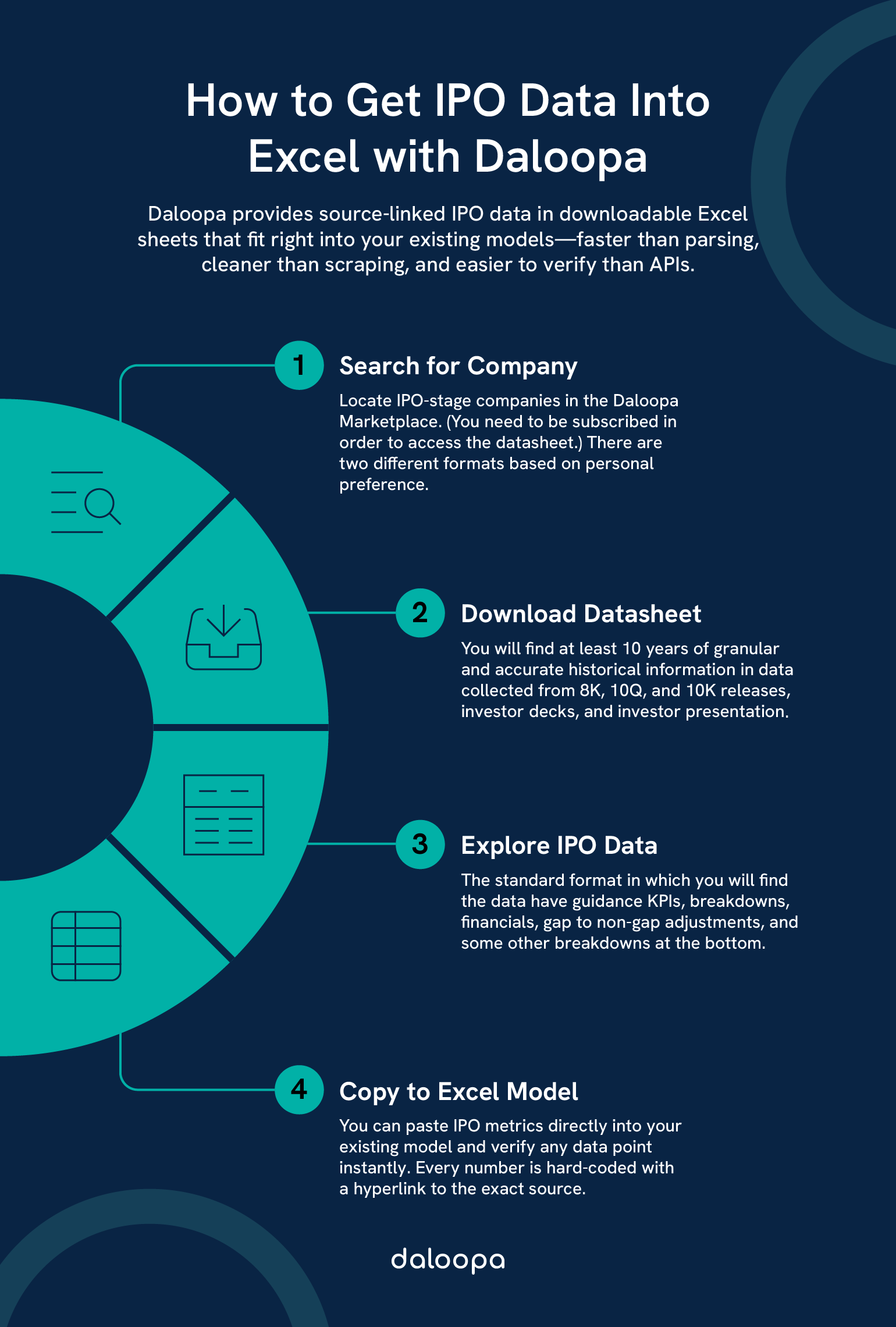

- Daloopa: Allows you to directly integrate an extensive amount of IPO data into existing Excel models.

- Capital IQ Excel Plugin: Known for its robust financial data coverage and ease of integration.

- FactSet Office Connect: Offers real-time data feeds and advanced analytical templates.

- Thomson Reuters Eikon: Delivers comprehensive market data and powerful analytics tools.

These add-ins automate the data import process and ensure that your models maintain consistency and accuracy. Their pre-built templates allow you to set up dashboards that monitor IPO trends quickly, compare industry metrics, and track financial performance over time.

Step-By-Step Guide To Import IPO Data

Building a repeatable, automated system for importing IPO data into Excel requires a thoughtful approach. This section breaks down the process into manageable steps, ensuring your data remains accurate, timely, and actionable. It’s all part of learning how to get IPO data into Excel and managing it efficiently.

Setting Up API Connection

Financial data providers offer dedicated developer portals where you can obtain access credentials and review documentation on integrating their API with Excel.

Steps to Connect:

- Retrieve Your API Key: Secure your access key from your chosen provider.

- Install the Necessary Connector: Use Excel’s built-in functions or third-party connectors that support your API.

- Adjust Data Scope Settings: Ensure your connection pulls the relevant IPO metrics (e.g., pricing, volume, filing dates).

- Run a Trial Query: Test with a sample query to confirm that your connection is successful.

- Store API Details Securely: Document all credentials and connection parameters in a secure worksheet using named ranges to organize data points like stock tickers or IPO dates.

Writing VBA Scripts For Data Automation

VBA scripts play a crucial role in maintaining an up-to-date dataset without continuous manual intervention. Launch the Visual Basic Editor and build a module with routines to automate your data processes. This is a key step in learning how to automate financial data in Excel.

Essential VBA Routines:

- RefreshIPOData(): Synchronizes API feeds or external sources with your workbook.

- FormatIPOTable(): Applies consistent layout rules and design elements.

- ValidateData(): Checks for missing or out-of-range data points to maintain accuracy.

Include error handling routines like On Error GoTo to manage dropped connections or unexpected data formats. Additionally, integrate scheduling tools like Task Scheduler or Excel’s own timed triggers to run your macros automatically.

Installing And Using Excel Add-Ins

Excel add-ins simplify the integration process for those who prefer a plug-and-play solution. These tools can pull curated IPO feeds into your workbook, requiring minimal setup and configuration. If you want to learn how to get IPO data into Excel, these add-ins are a great option for seamless integration.

Steps to Leverage Add-Ins:

- Choose an Add-In: Select from trusted options like Daloopa, Bloomberg Excel API, Power Query, or Eikon Add-In.

- Install Through Excel’s Add-In Manager: Enable the add-in via Excel’s built-in manager or download it from the vendor’s secure website.

- Configure Refresh Rules: Set up how often your data should update and map the fields from the add-in to your Excel templates.

- Utilize Reusable Data Cleanup Steps: Leverage Power Query’s capabilities to establish dynamic data models that adapt to real-time feeds.

Best Practices For Managing IPO Data In Excel

Maintaining a robust, error-free IPO database requires more than just importing data—it demands careful planning, organization, and ongoing maintenance.

The following best practices ensure your data remains accurate and actionable, even as market dynamics evolve.

Ensuring Data Accuracy And Integrity

To safeguard your analysis, implement strict data validation rules that prevent errors from creeping into your workbook. Use drop-down lists for fields like industry type or underwriter to minimize manual entry mistakes. Named ranges also simplify formulas, ensuring that your calculations always reference the correct data.

Key Strategies Include:

- Locking Your Template: Apply worksheet protection to secure critical formulas while allowing input only where necessary.

- Conditional Formatting: Set up rules to highlight anomalies—such as extreme pricing fluctuations, missing dates, or sector mismatches—so you can address issues before they affect your analysis.

- Data Validation: Use Excel’s built-in validation tools to restrict input values, ensuring that each entry conforms to expected formats.

Optimizing Excel For Large IPO Data Sets

Working with large datasets demands smart strategies to keep your workbook responsive and efficient. Break your model into multiple sheets; designate one sheet for raw data, another for analysis, and yet another for visual dashboards. This segmentation helps isolate performance-heavy operations, critical for financial analysis in Excel.

Performance Optimization Tips:

- Use Excel Tables: Excel Tables automatically adjust with new data, offering built-in filtering, sorting, and formula automation.

- Disable Auto-Calculation: For large files, switch off automatic calculations and refresh only when needed, reducing lag and improving performance.

- Trim Unnecessary Data: Remove extra formatting and delete unused rows or columns to minimize file size. Prefer INDEX-MATCH over VLOOKUP in complex datasets to improve speed.

- Segment Data Workloads: Consider splitting massive datasets into separate workbooks or using external data models if performance issues persist.

Empowering Strategic Decision-Making

When IPO data flows seamlessly into Excel, the platform transforms into a strategic command center. Your clean, connected data forms the foundation for actionable insights, allowing you to build robust IPO performance models and dashboards that drive confident decision-making. Automating financial data in Excel enhances this process and makes it more efficient.

Strategic Benefits Include:

- On-Demand Modeling: Create a risk-optimized framework for IPO prediction with dynamic models that adjust to various pricing scenarios, allowing for risk testing and scenario analysis.

- Tailored Valuation Logic: Customize formulas to fit your unique investment criteria and analysis style.

- Interactive Dashboards: Build pivot tables, charts, and dashboards that visualize IPO timelines, sector trends, and historical pricing patterns in real time.

- Collaborative Analytics: Real-time data updates empower your team to respond quickly to market shifts, making group decision-making more effective.

Real-World IPO Strategy Examples:

- Klarna’s F-1 filing reveals valuable insights into the risks and opportunities of IPO-stage fintechs—an essential reference when modeling peer comparisons.

- Analysts tracking post-IPO performance often work with massive datasets. See who came out on top in the ServiceTitan IPO aftermath, with a breakdown of winners and losers post-listing.

- If you’re tracking IPO momentum, check out why ServiceTitan needs to IPO to better understand valuation urgency in late-stage startups.

- Looking at Smithfield Foods’ renewed IPO attempt can offer a roadmap for tracking IPO readiness after a long private stretch.

Simplify How to Get IPO Data Into Excel

Transform your financial analysis in Excel today with Daloopa’s seamless integration tools. Take advantage of our extensive IPO data for these companies:

- Klarna

- Stripe

- CoreWeave

- Cerebras Systems

- Circle Internet Financial

- Bolt

- Mindbody

- Chime

- StubHub

- Databricks

Use our tool to automate financial data in Excel and integrate all IPO data into Excel spreadsheets effortlessly. Sign up for Daloopa now and streamline your IPO tracking with real-time, accurate data at your fingertips!