Extracting financial data from APIs into Excel is a powerful skill that will improve your financial analysis capabilities and streamline your workflow. Connecting an API to Excel offers significant benefits, including increased efficiency, accuracy, and access to real-time data, enabling more informed decision-making.

This guide will begin by highlighting the advantages of APIs for financial data analysis. We will discuss the basics needed to integrate APIs with Excel, using tools like Power Query, VBA, and various add-ins to connect with financial APIs, retrieve data, and manipulate them directly within Excel.

This guide will also provide practical examples to illustrate how financial APIs can be used effectively. From retrieving stock prices to automating financial statement downloads, these examples will demonstrate how we can optimize our workflow and present data in a visually compelling manner.

Skip to:

Setting up the Basics for Financial Data Extraction

How to Integrate Excel and API? – Two Options

Enhancing Financial Reporting with API-Driven Excel Visuals

Best Practices and Tips for Excel API Integration

What Is an API?

An API, or Application Programming Interface, serves as a bridge between different software applications, allowing them to communicate and share data seamlessly. In finance, APIs enable access to various types of financial data, such as structured, unstructured, and historical data, stored in different ecosystems. This technology simplifies the integration of complex financial systems by offering predefined functions and operations.

For instance, APIs allow us to retrieve real-time data from stock markets or historical pricing data from financial databases. By using APIs, we can automate data extraction processes, enabling smoother integration for creating dynamic financial models and dashboards in tools like Excel.

Why Use APIs for Financial Data?

Operational efficiency: APIs significantly reduce the time and effort required to obtain financial data from multiple sources. Instead of manually downloading reports or copying and pasting data, APIs automate these tasks, freeing up time for more strategic analysis.

Real-time data access: APIs provide access to real-time market data, which is critical for making timely investment decisions. This enables us to react quickly to market changes, enhancing our decision-making process.

Structured and unstructured data integration: APIs can handle both structured and unstructured data, allowing comprehensive analyses that handle multiple data formats. This versatility is crucial for conducting thorough financial research.

Scalability and flexibility: APIs are highly scalable, meaning they can handle large volumes of data without a significant performance drop. They offer flexibility, allowing us to customize the data retrieval process based on our specific needs.

Setting up the Basics for Financial Data Extraction

To extract financial data from APIs to Excel, it’s important to start by preparing the essentials. This involves understanding the prerequisites for API integration and ensuring proper API key authentication.

Phase 01: Prerequisites for API Integration

Before we begin, we will need the right tools and dependencies. The Python programming language is one of the best tools for API integration due to its robust library support, including libraries such as `requests` and `pandas`, which help in fetching and manipulating data. If developing in C#, we’ll need a suitable development environment like Visual Studio.

Step 01: Install Python from the official website and set it up.

Step 02: Verify that you have a compatible version of Excel installed on your computer – This is crucial for successful integration and smooth operation.

Step 03: Using a package manager like `pip `, install any necessary Python libraries. You can use the following command:

pip install requests pandas openpyxl

Openpyxl helps in the direct manipulation of Excel files. By setting up these dependencies, we lay a solid foundation for handling API data.

Phase 02: API Key and Authentication

Securing an API Key is often the first step in accessing a financial data API. This key typically acts as a unique identifier and helps in tracking usage. Watch this video to learn how to authenticate and use an API with Python or follow the steps below:

Step 01: Sign up on the relevant API provider’s website.

Step 02: Retrieve the API key. Most providers guide you through generating and retrieving an API key. Store this key securely. It’s advisable to use `environment variables` to manage keys safely, without exposing them in your code. Learn how to load and manage API keys in Python here.

Step 03: Understand the authentication process specified by the API provider. Some APIs may require additional steps, such as using OAuth.

Step 04: Configure the Python scripts or Excel Add-In to include your API key in the requests.

By setting up proper authentication, we ensure secure and efficient access to financial data from APIs.

How to Integrate Excel and API? – Two Options

Integrating APIs with Excel is essential for extracting and processing financial data efficiently. By using built-in features and custom solutions, we can automate and customize data workflows to fit specific needs. A use case example is using APIs to pull real-time data into spreadsheets and utilizing programming languages like Python to handle complex tasks.

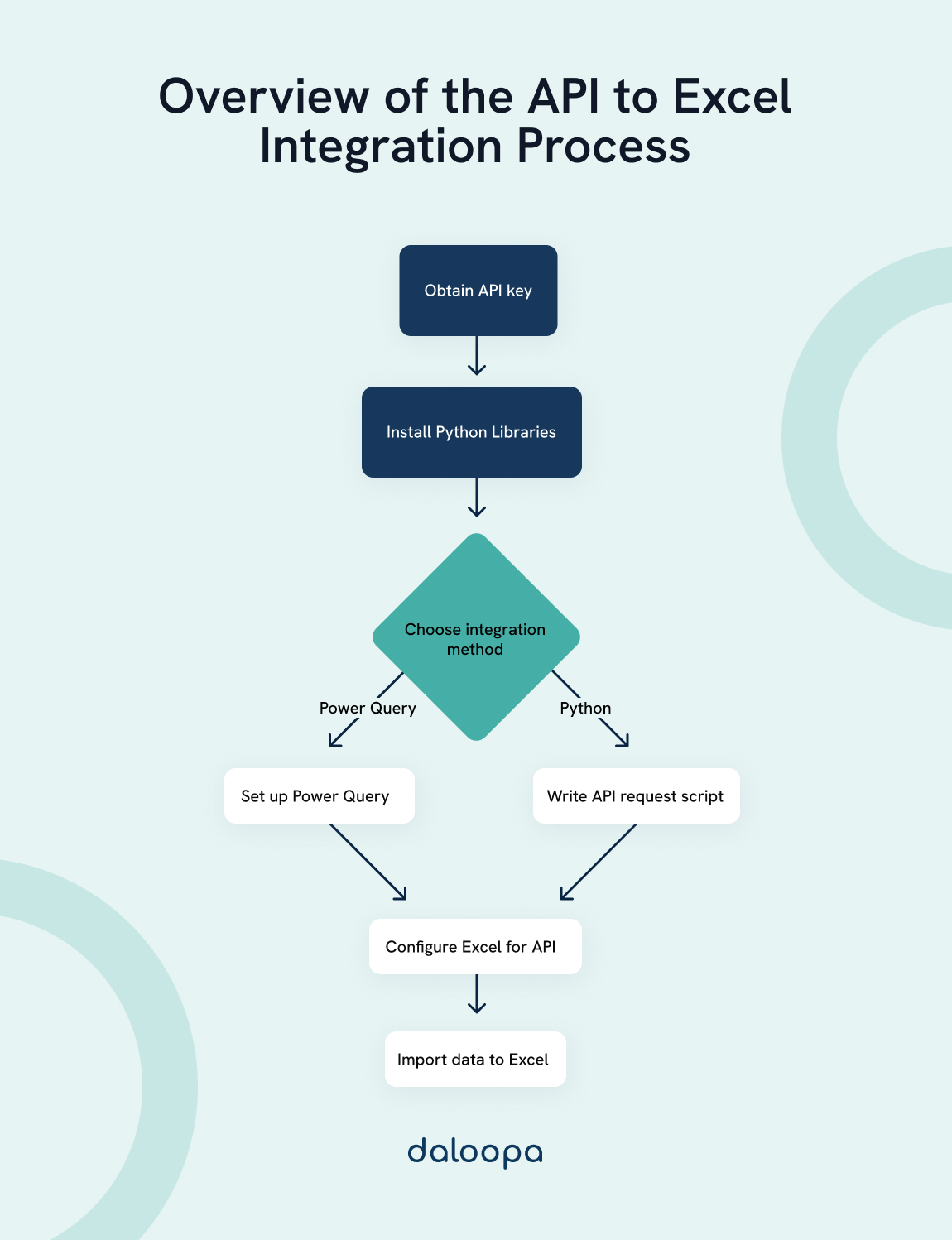

You can integrate APIs with Excel either by using Excel’s built-in features or by using Python and Pandas.

Option 1: Simple API Integration Using Excel’s Built-In Features

Excel offers built-in features to facilitate API integration. One of the primary tools is Power Query, also known as Get & Transform Data.

Power Query allows us to connect to web APIs, import data, and transform it within Excel. We can automate data extraction by scheduling refreshes, ensuring our financial data remains current.

Web Data Import:

- Navigate to Data > Get Data > From Other Sources > From Web.

- Enter the API URL.

- Configure authentication if needed.

Excel also supports Excel Web Queries and the WEBSERVICE function to fetch data directly from web services.

These built-in tools are user-friendly and don’t require extensive programming knowledge. They are best for standard data retrieval tasks where heavy customization is not needed.

Option 2: Customized API Integration Using Python and Pandas

For more complex and tailored API integration, we can use Python and Pandas. Python scripts allow us to write custom API requests and manipulate the data precisely as required.

Pandas DataFrames is a powerful data manipulation tool that helps in structuring data retrieved from APIs. By using Python libraries like `requests` and `pandas`, we can extract data directly into Pandas DataFrames.

Example Workflow:

- Use the requests library to make an API call.

- Convert the response to JSON.

- Load JSON data into a Pandas DataFrame.

- Export the DataFrame to Excel using df.to_excel().

This method offers extensive customization and automation options. It’s ideal for users who need to handle large datasets, perform intricate data transformations, or integrate multiple data sources.

Enhancing Financial Reporting with API-Driven Excel Visuals

Visual presentation and reporting are critical elements when extracting financial data from APIs to Excel. Effective use of charts, formulas, and data management tools enhances data interpretation and decision-making.

Creating Charts and Dashboards

When working with financial data, creating charts helps in visualizing key data points such as dividends and market trends. Excel allows us to utilize various chart types like bar charts, line charts, and pie charts. These can be created by selecting the data range and using the ‘Insert’ tab to choose the desired chart format.

Dashboards integrate multiple visual elements to provide a comprehensive view of financial performance. We can use pivot tables to summarize large amounts of data, which can then be linked to charts. This integration not only enhances the user interface but also allows for easy updates whenever new data is extracted via APIs.

Using Formulas for Tailored Reports

Formulas in Excel are useful for generating tailored financial reports. Using functions like SUMIFS, AVERAGEIFS, and VLOOKUP facilitates the organization and categorization of extracted data. For instance, SUMIFS helps aggregate data points based on specific criteria such as month or year.

Custom formulas can be developed to calculate critical financial metrics like ROI or to provide insights on dividend yields. These formulas can be embedded within cells, allowing for dynamic updates as new data is retrieved. This approach ensures ease of use and promotes accurate reporting for informed decision-making.

Best Practices and Tips for Excel API Integration

Maintaining Privacy and Data Security

To successfully integrate financial data from APIs into Excel, focus on maintaining data security and ensuring the accuracy and reliability of the data. Here are some best practices and tips you should follow.

Employ encrypted connections

Privacy and data security are paramount, especially in the finance sector where sensitive financial information is handled. When integrating APIs with Excel, use encrypted connections like HTTPS to protect data during transmission.

Limiting data access to authorized users only

Role-based access control (RBAC) ensures that only specific users can view or manipulate the data.

Update APIs and Excel Regularly

Regular updates help address vulnerabilities that hackers could exploit.

Use multi-factor authentication (MFA)

Requiring multiple forms of verification before granting access to confidential data adds another layer of security. This reduces the likelihood of unauthorized access, safeguarding both investor data and operational efficiency.

Enhancing Accuracy and Reliability

Accuracy and reliability are crucial when dealing with financial data. Ensuring that the data extracted from APIs is accurate starts with selecting reliable and well-documented APIs. Detailed API documentation assists in understanding the data endpoints and how to interact with them effectively.

Validating the data upon receipt can prevent errors. Implementing checks and balances within Excel, such as conditional formatting and data validation rules, helps in flagging discrepancies promptly.

Automating these processes reduces manual intervention, which can introduce errors. Automation also boosts operational efficiency, allowing us to consistently maintain high data accuracy. By scheduling regular data updates, we can ensure that our Excel sheets always reflect the most current financial data available.

Conclusion and Further Resources

We have discussed different methods of extracting financial data from APIs and integrating it into Excel. By leveraging these methods, data scientists and developers can streamline data analysis and enhance financial applications.

For those looking to go deeper, some additional resources are listed below:

- Financial Applications Using Excel Add-in Development in C/C++: A guide on integrating financial data using C/C++ here.

- Python for Finance: A comprehensive guide to analyzing financial data with Python. It provides practical tips on using Python in finance here.

- Unlocking Financial Data: Offers useful examples in C# for accessing market data here.

Are You Maximizing Your Efficiency with Real-Time Financial Data?

In today’s fast-paced financial environment, timely and accurate data is crucial for making informed investment decisions. Are you still relying on manual data entry and outdated methods to gather financial insights? Daloopa empowers investment analysts like you to seamlessly integrate financial data from APIs directly into Excel, streamlining your workflow and boosting accuracy. Imagine having real-time data at your fingertips, ready to drive smarter decisions. Create your free Daloopa account today and revolutionize how you handle financial data.