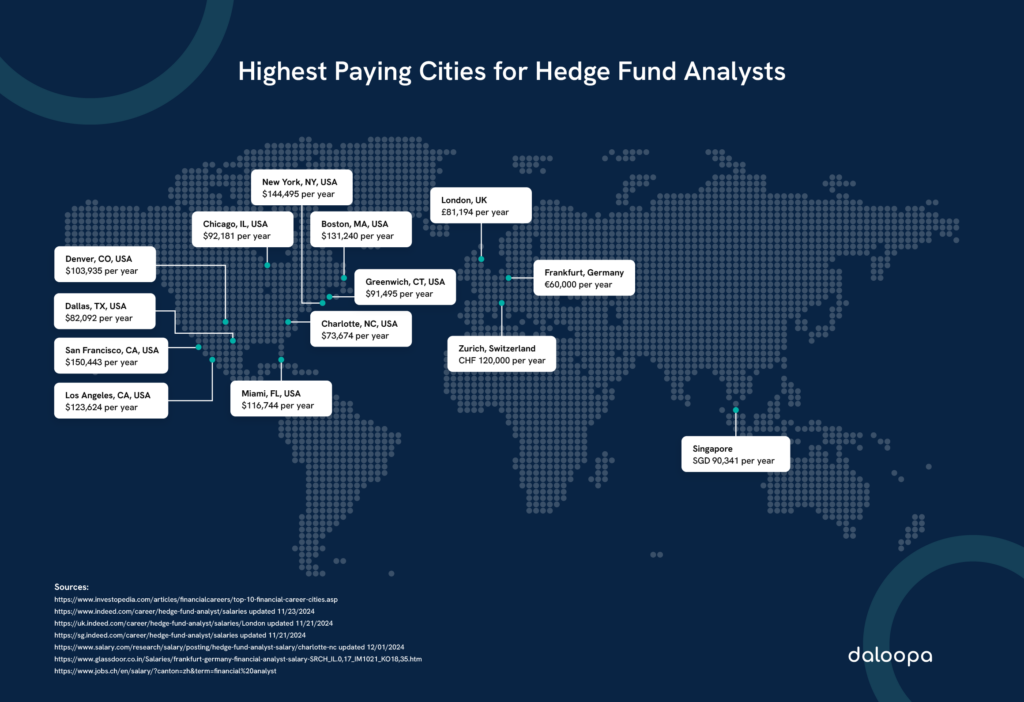

Imagine a hedge fund analyst in NYC, earning six figures and building a fast-paced career. In London, another thrives in the bustling financial district. Meanwhile, Miami is quietly rising as a new player in the hedge fund scene.

Once dominated by Wall Street and the City of London, the hedge fund landscape is evolving, with Miami emerging as a new contender. In NYC, entry-level hedge fund analysts command salaries ranging from $100,000 to $200,000, enhanced by unparalleled opportunities for growth. London offers similarly competitive compensation and a unique specialization in global macro funds while slightly trailing in absolute pay due to currency disparities.

Though still trailing these giants, Miami is riding a wave of rapid hedge fund activity, steadily closing the gap in analyst pay. Beyond salaries, the dynamics of hedge fund distributions, strategic specialization, and the stark contrasts in the cost of living between these cities shape the decision-making of ambitious professionals navigating this high-stakes industry.

Let’s take this picture and expand on how analyst salaries in top hedge fund cities – NYC, Miami, London & more compare around the world.

Key Takeaways

- Hedge fund analyst salaries peak in NYC, followed by London, with Miami emerging as a competitive alternative.

- Specialization in fund strategies can profoundly impact career growth and earning potential.

- Cost of living plays a crucial role in comparing the value of salaries across financial centers.

Overview: Hedge Fund Analyst Salaries Across Hubs

Hedge fund analyst compensation by city varies significantly across global financial centers. Using data from leading industry sources, we’ve analyzed analyst salaries in top hedge fund cities such as NYC, Miami, vs London and the world to provide a clearer picture of this evolving landscape.

New York City remains the global leader in hedge fund analyst salaries, with base pay for entry-level positions ranging from $80,000 to $120,000. Total compensation, factoring in bonuses, often reaches $150,000 to $200,000, with exceptional analysts earning even more.

London follows closely, with entry-level salaries of £60,000 ($63,475) to £90,000 ($95,212) and total compensation packages of £100,000 ($105,792) to £150,000 ($158,688). Despite being a newer entrant, Miami offers hedge fund analyst salaries about 10-15% below NYC levels, but its lower cost of living and tax advantages make it a viable option.

While these figures provide a baseline, individual earnings can vary based on fund size, specialization, and performance. Top-tier funds often reward exceptional talent with significantly higher pay.

Understanding Hedge Fund Analyst Roles

As a hedge fund analyst, you are integral to your firm’s success. Your role, responsibilities, and areas of specialization shape your career trajectory and earning potential.

Defining the Analyst Role in Hedge Funds

The analyst is at the heart of a hedge fund’s operation and is responsible for detailed research and strategic input. Entry-level analysts focus on specific industries or asset classes, handling tasks like:

- Conducting comprehensive financial research

- Creating and refining financial models

- Evaluating potential investments through due diligence

- Monitoring market and economic trends

As analysts gain experience, they move into senior roles, assuming responsibilities such as:

- Leading in-depth research initiatives

- Presenting and defending investment ideas to portfolio managers

- Coaching junior analysts to enhance overall team performance

Industry Specializations and Their Impact on Salaries

Specialization plays a pivotal role in determining an analyst’s earning potential. Analysts with expertise in high-demand areas or niche strategies often command premium salaries. For instance:

- Tech and healthcare analysts are especially valued for their ability to navigate complex and rapidly evolving sectors.

- Armed with advanced programming and mathematical skills, quantitative analysts are highly sought after by multi-strategy and systematic funds.

- Emerging market specialists bring unique value to funds focused on global diversification.

These specializations also shape geographic opportunities. While NYC offers a broader array of roles across multiple sectors, London stands out for its strength in global macro strategies and European markets.

Comparative Analysis of Hedge Fund Analyst Salaries

Regional competition, cost of living, and market dynamics shape hedge fund analyst salaries across financial hubs. Here’s an in-depth comparison of analyst salaries in top hedge fund cities such as NYC, Miami, vs London and the world.

New York City: The Financial Powerhouse

New York City consistently offers some of the highest salaries for hedge fund analysts. Entry-level salaries range from $80,000 to $120,000, with total compensation exceeding $200,000 for many analysts, thanks to performance bonuses.

Exceptional analysts at top funds often earn $300,000 or more within a few years. Compensation structures typically combine a generous base salary with performance-linked bonuses and, at senior levels, profit-sharing arrangements.

Miami: An Emerging Hub

Miami’s growing reputation as a financial center has sparked demand for hedge fund talent. Entry-level salaries range from $70,000 to $100,000, with total compensation packages between $120,000 and $180,000. The city’s lack of state income tax and lower cost of living make these salaries particularly appealing.

Miami’s relaxed lifestyle and emerging financial network provide a compelling alternative to traditional financial hubs.

London: Europe’s Financial Capital

London remains a key player, with salaries just behind NYC’s. Entry-level analysts earn £60,000 to £70,000 ($63,500 to $74,000), with total packages reaching £80,000 to £120,000 ($84,500 to $127,000).

Although higher taxes and living costs reduce net earnings, London’s vibrant financial market and global connectivity offer unparalleled career advancement opportunities.

Comparative Overview: Boston, Chicago, and Dubai

While cities like New York, London, and Miami dominate the global hedge fund narrative, Boston, Chicago, and Dubai also play significant roles in the financial ecosystem, each offering unique opportunities for hedge fund analysts:

- Boston: Known for its emphasis on biotech and healthcare investments, Boston offers competitive analyst salaries ranging from $85,000 to $140,000, with total compensation often exceeding $180,000 in top-tier funds. Its proximity to leading universities and a strong research-driven ecosystem make it an attractive hub for specialized roles.

- Chicago: Renowned for its focus on derivatives and commodities, Chicago hedge funds often value analysts with expertise in quantitative strategies. Entry-level salaries range from $75,000 to $120,000, with total packages reaching $150,000 or more. The relatively lower cost of living compared to NYC enhances its appeal.

- Dubai: A growing financial center in the Middle East, Dubai’s hedge fund industry is still developing but offers unique advantages, such as tax-free income and exposure to emerging markets. The average salary for analysts in Dubai sits around $43,000, with total compensation packages varying widely depending on the fund’s size and focus.

Each of these cities caters to distinct niches within the hedge fund industry, influenced by their economic profiles and regulatory environments.

World View

Beyond the commonly discussed financial hubs, hedge fund analysts in other global cities also command competitive salaries. Here’s a snapshot:

- Hong Kong: A gateway to Asian markets, Hong Kong offers salaries ranging from $40,000 to $45,000. Analysts with expertise in China-focused strategies are particularly in demand.

- Singapore: Like Hong Kong, Singapore is a key hub for Asia-Pacific investments. Salaries range from $65,000 to $90,000, with total packages often exceeding $150,000 for top performers.

- Zurich and Geneva: Known for their private banking legacy, Swiss cities offer salaries of $80,000 to $120,000, with total compensation between $130,000 and $180,000. The strong Swiss franc and high living standards add unique appeal.

- Tokyo: Hedge fund analysts in Tokyo earn $45,000 to $55,000 at the entry-level, with bonuses bringing total compensation to $60,000 or more. Fluency in Japanese and expertise in local markets are often prerequisites.

While less prominent than NYC or London, these cities present robust opportunities for hedge fund analysts, particularly those seeking regional expertise or unique lifestyle advantages.

Cost of Living and Lifestyle Considerations

Salaries alone don’t tell the full story. Factoring in living costs and lifestyle preferences is essential for professionals evaluating career options.

Balancing Salary with Living Costs

High salaries in NYC and London often come with steep living expenses, significantly affecting disposable income:

- Housing Costs:

- In New York City, a one-bedroom apartment in Manhattan averages $3,500 per month, consuming a significant portion of even a six-figure salary.

- In London, similar accommodations cost approximately £2,000 ($2,100), compounded by additional council taxes and higher utility costs.

- Miami presents a more affordable option, with average rents closer to $2,000 and no state income tax, leaving analysts with more disposable income to allocate toward investments or leisure.

- Transportation Expenses:

- NYC and London boast extensive public transit systems, with monthly metro passes costing around $130 and £150 ($160), respectively.

- Miami’s car-centric lifestyle introduces additional costs such as car payments, insurance, and fuel, but its overall affordability often offsets these expenses.

- Taxes:

- London’s progressive tax rates and national insurance contributions result in a higher effective tax burden.

- NYC analysts face both federal and state income taxes, while Miami’s lack of state tax provides a distinct financial advantage.

Lifestyle and Career Growth Opportunities

Beyond salaries and expenses, the lifestyle and professional landscape in these cities play a pivotal role in career satisfaction:

- New York City:

- As a global financial epicenter, NYC offers unparalleled networking opportunities and exposure to diverse investment strategies. However, the city’s fast pace often leads to long work hours, leaving little time for personal pursuits. For those seeking adrenaline-fueled careers, NYC remains unmatched.

- World-class dining, Broadway shows, and cultural landmarks add to the city’s allure but at a premium cost.

- London:

- London’s financial district provides strong career growth opportunities, particularly in global macro funds and European markets. The city’s slightly more balanced work culture may appeal to professionals seeking less intense environments compared to NYC.

- London also offers historic charm, rich cultural diversity, and weekend getaways to European destinations, making it a unique lifestyle hub.

- Miami:

- Miami’s vibrant financial scene is rapidly growing, making it an attractive destination for hedge fund professionals looking to escape the traditional hustle of NYC or London.

- The city’s warm weather, beaches, and focus on outdoor living create a work-life balance that’s hard to find elsewhere. While its financial ecosystem is still maturing, it provides a fertile ground for ambitious professionals to make a mark.

Disposable Income and Lifestyle Trade-offs

A clearer picture emerges when factoring in disposable income—the amount left after taxes and essential living expenses:

- In NYC, despite high salaries, the combination of elevated rent, taxes, and daily expenses often leaves less room for savings or discretionary spending.

- London offers competitive pay, but its higher tax rates and cost of living can narrow the gap between income and expenses.

- Miami’s lower rent, absence of state income tax, and relatively affordable lifestyle allow analysts to enjoy higher disposable income, enabling a greater focus on long-term financial goals or leisure activities.

For hedge fund professionals, choosing a financial hub involves not just comparing salaries but evaluating the total value of compensation, lifestyle fit, and opportunities for career advancement.

Strategic Career Planning

A strategic approach to career planning involves aligning goals with geographic preferences and staying ahead of industry trends.

Aligning Career Goals with Financial Hubs

Choosing the right financial center requires evaluating personal preferences and professional aspirations. While NYC and London offer the highest pay and most opportunities, Miami’s growth provides an exciting alternative.

Key considerations for hedge fund analyst career planning include:

- Identifying sector and strategy preferences

- Researching opportunities in desired locations

- Building certifications, such as the CFA, to enhance qualifications

Future Outlook for Hedge Fund Careers

As an analyst, you can future-proof your career by:

- Gaining expertise in emerging investment approaches

- Adapting to technological advancements

- Expanding your global professional network

- Pursuing continuous professional development

Anticipating these shifts positions hedge fund professionals to capitalize on emerging opportunities.

Maximizing Career Success in Hedge Funds

Achieving success in the hedge fund industry requires more than technical skills. It demands adaptability, continuous learning, networking, and a strategic approach to professional growth.

Developing Specialized Skills and Expertise

To stand out in the competitive hedge fund industry, cultivating niche expertise is key:

- Focus on high-demand sectors or strategies: Specializing in technology, healthcare, or quantitative investing can make you indispensable. For example, a junior analyst at a top-tier fund like Citadel might gain recognition for mastering algorithmic trading or building predictive models.

- Invest in technical skills: Programming languages like Python, R, and SQL are now as essential as Excel. For instance, analysts who automate complex tasks using Python often streamline operations, earning recognition for their efficiency.

- Learn from real-world scenarios: An anecdote from a hedge fund professional illustrates this point—a junior analyst who identified a hidden arbitrage opportunity in a niche market saw their idea generate significant returns, securing them a promotion.

Continuous Learning and Professional Development

The hedge fund landscape evolves constantly, making ongoing education a career imperative:

- Pursue advanced qualifications: Certifications like the CFA or a master’s degree in finance or data science can strengthen your analytical capabilities.

- Immerse in industry trends: Subscribe to financial publications like The Hedge Fund Journal or attend conferences such as SALT to stay ahead of market innovations.

- Leverage on-the-job learning: A senior analyst once shared how shadowing experienced traders during volatile markets helped them understand nuanced strategies that no textbook could teach.

Networking and Building Relationships

Networking is not just about collecting business cards—it’s about creating meaningful connections:

- Be intentional at events: At an industry conference, approach speakers or panelists with thoughtful questions about their expertise. For instance, following up with a keynote speaker via LinkedIn can foster mentorship opportunities.

- Strengthen internal relationships: Build trust with colleagues by consistently delivering results and offering support on collaborative projects. A manager might advocate for your promotion based on your teamwork.

- Engage in alumni networks: A hedge fund professional once landed their role after reconnecting with a university alum who introduced them to a fund hiring for niche expertise.

Delivering Exceptional Performance

Your performance is your reputation in this results-driven industry:

- Go beyond the brief: An example of exceptional work includes an analyst who presented a contrarian investment thesis backed by extensive research, resulting in a portfolio gain that exceeded targets.

- Seek feedback proactively: A portfolio manager praised an analyst who regularly sought constructive criticism, refining their approach and improving outcomes.

Embracing Adaptability and Communication

Adaptability and clear communication can set you apart in high-pressure environments:

- Be ready to pivot: A hedge fund analyst shared how they shifted focus during a sudden market downturn, proposing a hedging strategy that minimized losses and earned the team accolades.

- Hone storytelling skills: Presenting data-driven insights in a compelling narrative can make your ideas memorable. Clarity and persuasion are critical when explaining complex models to a client or pitching to portfolio managers.

Gaining a Global Perspective

Expanding your experience to different financial hubs adds depth to your expertise:

- Rotate across markets: Working in New York, London, or Hong Kong exposes you to diverse strategies and regulatory landscapes. For example, an analyst who moved from Miami to London gained valuable insights into global macro funds, enhancing their market versatility.

- Embrace cultural learning: Understanding regional nuances can improve your ability to collaborate with international clients or teams.

As the hedge fund industry continues to evolve, understanding hedge fund analyst compensation by city is essential for making informed career decisions. Comparing analyst salaries in top hedge fund cities such as NYC, Miami, vs London and the world highlights the opportunities and trade-offs each location offers. By analyzing factors like cost of living, career growth potential, and specialization, professionals can strategically align their goals with the right financial hub.

Improve Your Workflow with Daloopa

In the competitive field of hedge funds, every minute counts. Aspiring hedge fund analysts pursuing opportunities in the high-stakes markets of NYC, leveraging global macro insights in London, or capitalizing on Miami’s emerging financial scene, must prioritize precision and efficiency. Daloopa saves hedge fund analysts thousands of hours by automating manual data tasks, allowing you to focus on high-impact decisions that drive performance.

Let Daloopa handle the tedious work so you can concentrate on delivering results. Request a demo today.