As hedge fund analysts, you must rigorously assess investment opportunities to remain competitive. Your ability to interpret complex strategies and performance metrics allows you to manage risks effectively and explore advanced investment vehicles.

Competitive analysis involves synthesizing data to derive actionable insights. Hedge fund performance metrics assess success and identify risks, while robust investment analysis techniques inform risk management frameworks.

Key Takeaways

- Understanding hedge funds and performance metrics causes informed investment decisions.

- Investment analysis techniques and risk management frameworks are essential in competitive finance.

- The decision-making process relies on advanced tools and techniques for success.

Understanding the Hedge Fund Landscape

Understanding the hedge fund landscape helps you optimize your strategies and performance.

Types of Hedge Funds and Strategies

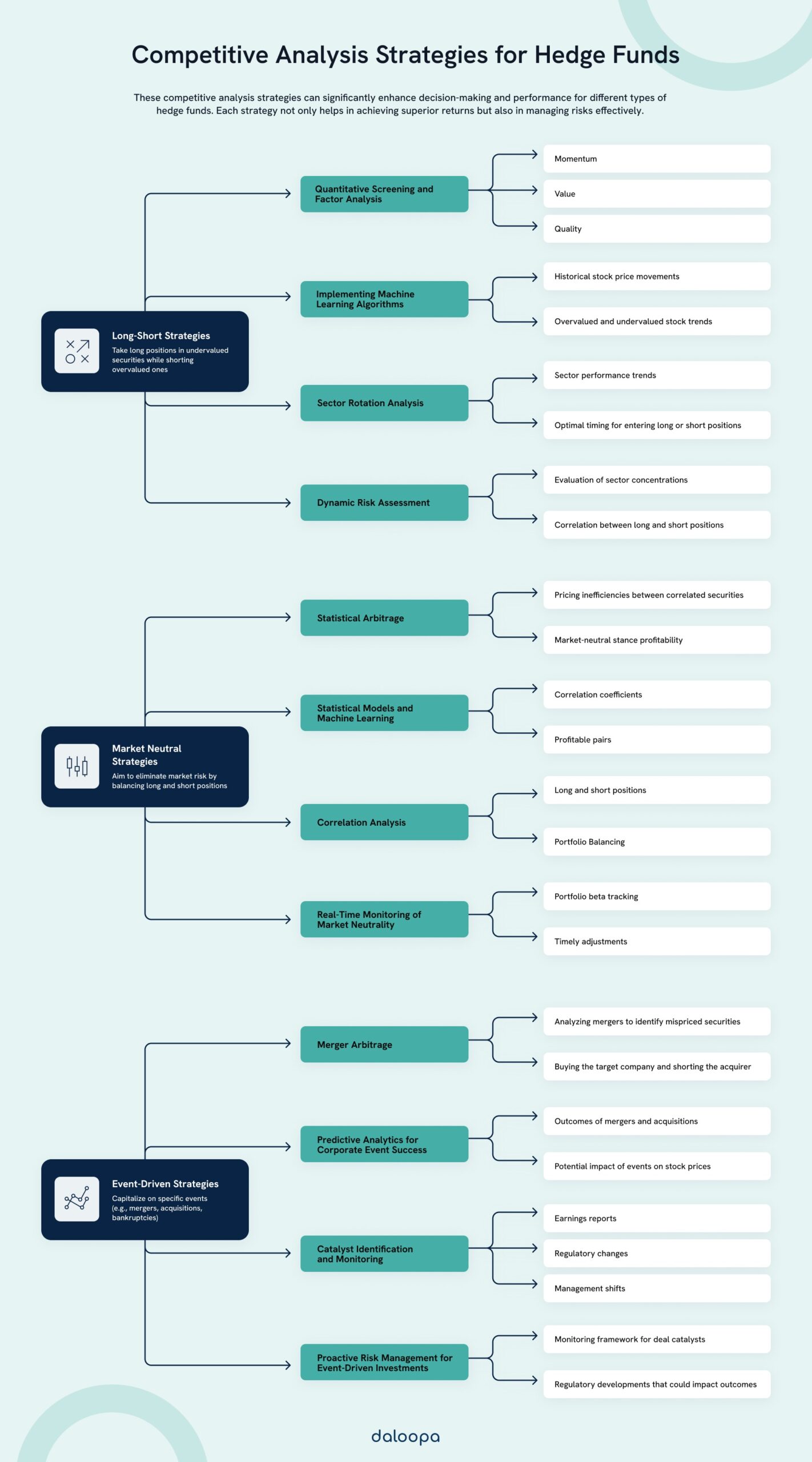

Strategies such as long-short equity, market-neutral, and event-driven approaches allow hedge funds to navigate both bullish and bearish markets, pursuing alpha through asymmetric risk exposures.

The scale of assets under management (AUM) further differentiates hedge funds from nimble boutique firms to large institutional players. Long-short equity strategies, for instance, exploit pricing inefficiencies by taking long positions in undervalued securities while shorting overvalued ones, enabling funds to hedge market exposure and enhance returns.

Event-driven strategies capitalize on corporate actions such as mergers, acquisitions, restructurings, or bankruptcies, often relying on deep analysis of legal, financial, and regulatory complexities to generate returns uncorrelated with broader market movements.

This diversity in strategies appeals to accredited investors seeking outsized returns and willing to assume higher levels of risk. With each strategy presenting distinct risk-return profiles, effective portfolio management hinges on dynamic allocation and rigorous risk assessment to optimize performance across varied market environments.

Regulatory Environment and Investor Base

Hedge funds operate in a constantly shifting regulatory environment, with evolving frameworks such as Dodd-Frank, MiFID II, and recent SEC amendments playing a significant role in shaping fund strategies. For instance, Dodd-Frank has increased transparency requirements, affecting how hedge funds manage derivatives and leverage. Similarly, MiFID II mandates more detailed reporting on trading costs and investor communications, which can alter execution strategies and fund expenses.

The hedge fund investor base primarily consists of accredited investors and institutional clients seeking higher returns. As regulations tighten, hedge funds must balance compliance with their goal of delivering superior returns while ensuring strong investor relationships.

Key Strategies for Competitive Analysis

In competitive analysis, hedge fund analysts employ sophisticated methodologies to evaluate and optimize investment strategies. These advanced techniques are designed to manage risk efficiently, allocate capital strategically, and uncover opportunities with superior risk-adjusted returns.

Asset Management and Allocation

A well-structured portfolio must align with the fund’s investment objectives and risk tolerance. Strategic asset allocation—diversifying investments across asset classes such as equities, fixed income, and alternative investments—enables funds to balance risk and return while dynamically adapting to shifting market conditions.

Dynamic allocation, or tactical adjustments based on macroeconomic trends or market opportunities, further enhances portfolio performance. Analysts can fine-tune asset distribution by integrating approaches like relative value assessments to achieve optimal financial outcomes and maintain flexibility in uncertain environments.

Fixed Income and Equity Strategies

Fixed income and equity strategies form the cornerstone of many hedge fund portfolios. Fixed income strategies, centered on bonds or credit instruments, focus on generating stable returns, while equity strategies aim for capital appreciation through stock investments. Combining these strategies allows for a diversified risk profile, blending growth and income generation.

Strategically balancing fixed income and equities enables the fund to manage volatility effectively. Event-driven strategies, such as capitalizing on corporate restructurings, mergers, or distressed assets, offer opportunities for growth in these asset classes, particularly in market dislocation or sector-specific disruptions.

Risk Assessment and Management

Comprehensive risk assessment and management underpin sustainable portfolio performance. Analysts must assess a range of economic, geopolitical, and market-specific risks. Advanced techniques, such as scenario analysis and stress testing, are employed to model potential adverse outcomes and their impact on portfolios.

Utilizing these risk management frameworks allows for proactive mitigation of downside risks, enhancing portfolio resilience. By identifying vulnerabilities and adjusting exposure accordingly, hedge funds can safeguard assets from market fluctuations and unexpected shocks, ensuring the long-term stability of returns.

Analysis of Market Trends and Conditions

Analyzing market trends and conditions informs your decision-making in hedge fund strategies. Technical analysis and macroeconomic trend monitoring guide strategic decisions, helping funds capitalize on favorable market conditions while avoiding downside risks.

Staying ahead of macroeconomic shifts and regulatory changes enables hedge funds to maintain a competitive advantage and remain agile in an evolving financial landscape.

Identification of Emerging Investment Opportunities and Strategies

Identifying emerging investment opportunities requires a forward-looking approach and a keen understanding of evolving markets. Analyzing technological innovation, regulatory developments, and socioeconomic shifts enables hedge funds to pinpoint sectors poised for growth.

Developing strategies to capture opportunities in these emerging landscapes helps you stay ahead in a competitive market. A proactive stance on market innovation ensures that hedge funds remain positioned to seize opportunities, driving long-term performance and capitalizing on shifts before they become fully realized by the broader market.

Deciphering Hedge Fund Performance Metrics

When evaluating hedge fund performance, your analysis must encompass quantitative measures and risk-adjusted returns. These metrics provide critical insights into a fund’s ability to generate returns relative to its risk exposure, guiding informed investment decisions.

Quantitative Indicators of Performance

A comprehensive performance evaluation begins with key quantitative metrics. Total return, which reflects a fund’s profit or loss over a specific period, forms the foundation of this analysis.

Alpha quantifies a fund’s ability to generate excess returns independent of market movements, serving as a gauge of managerial skill. In contrast, beta measures the fund’s sensitivity to market volatility, indicating its relative risk profile. Additionally, standard deviation provides a detailed view of return variability, while maximum drawdown highlights the extent of potential losses by measuring the largest decline from peak to trough during a specified period.

Risk-Adjusted Returns Analysis

The Sharpe ratio expresses the return per unit of risk by subtracting the risk-free rate from the fund’s return and dividing it by the standard deviation, allowing for meaningful comparisons across funds with different risk profiles.

The Sortino ratio offers a more refined perspective by focusing solely on downside risk, utilizing downside deviation instead of standard deviation, which evaluates a fund’s excess return relative to tracking error against a benchmark. By emphasizing downside risk, the Sortino ratio ensures a sharper focus on protecting capital during adverse market conditions.

By leveraging these risk-adjusted metrics, analysts gain deeper insights into a fund’s ability to generate returns efficiently relative to the risks assumed.

Investment Analysis Techniques

Analysts can align their strategies with market dynamics to enhance performance by synthesizing insights from macroeconomic indicators and rigorous statistical measures.

Financial Analysis and Economic Indicators

Analysts must monitor key macroeconomic indicators—such as GDP growth, inflation, and employment rates—to anticipate shifts in the broader financial landscape. These metrics provide critical insights into economic cycles, enabling funds to proactively adjust asset allocation and risk exposure in response to evolving market conditions.

Beyond macroeconomic data, detailed company analysis plays a pivotal role in uncovering value. Analysts gain a deeper understanding of a firm’s profitability, cash flow health, and capital structure by dissecting financial statements. This granular financial analysis, when integrated with macroeconomic context, empowers hedge fund professionals to forecast potential market movements and identify investments that promise favorable risk-adjusted returns.

Statistical Measures for Market Analysis

Statistical analysis complements financial insights by offering a quantitative view of market behavior. Metrics such as volatility, skewness, and kurtosis are instrumental in assessing market risk and return distribution. Volatility, for instance, provides a measure of market uncertainty—crucial for funds that aim to maximize returns while controlling for downside risk.

Skewness and kurtosis delve deeper into return distributions, highlighting asymmetries and tail risks that may not be apparent through traditional risk measures. These statistical tools enable analysts to detect anomalies in performance patterns and adjust their strategic positioning to capitalize on or mitigate unexpected outcomes. By continually refining investment strategies through statistical evaluation, hedge fund analysts maintain a nuanced understanding of market dynamics and improve decision-making across diverse market environments.

Developing a Robust Risk Management Framework

A robust risk management framework helps analysts navigate the complexities of financial markets.

Identifying and Assessing Risk Profiles

Effective risk management begins with precisely identifying and assessing various risk profiles. Analysts must rigorously examine potential drawdowns, considering both market risks—such as volatility and interest rate fluctuations—and non-market risks, including operational and liquidity challenges.

Analytical tools like Daloopa and stress testing are indispensable for quantifying these risks. Daloopa provides a statistical measure of potential portfolio losses over a specified time frame, while stress testing allows us to model extreme scenarios, uncovering vulnerabilities under adverse market conditions. By leveraging historical data and predictive models, we can anticipate the likelihood and impact of risk events, ensuring that our strategies are aligned with the fund’s risk tolerance and performance objectives.

Hedging Strategies and Diversification

Hedging and diversification form the cornerstone of sophisticated risk mitigation strategies. Hedging involves using derivatives—such as options, futures, and swaps—to counterbalance potential losses in our core positions. These instruments serve as critical buffers against market downturns, enabling you to maintain portfolio stability in the face of adverse price movements or macroeconomic shocks.

Diversification, meanwhile, entails distributing investments across multiple asset classes, sectors, and geographies to reduce exposure to any single risk factor. By spreading risk, we enhance the resilience of our portfolios, minimizing the impact of idiosyncratic events on overall performance. A strategic blend of asset allocation, geographical diversification, and sector rotation allows us to achieve balanced risk exposure while positioning the portfolio to capitalize on diverse market conditions.

Exploring Advanced Investment Vehicles

By analyzing alternative asset classes alongside the strategic deployment of derivatives and leverage, hedge fund analysts can gain a deeper understanding of these complex tools and their role in modern portfolio management.

Navigating Alternative Asset Classes

The inclusion of alternative asset classes within hedge fund portfolios presents a wealth of opportunities that extend beyond traditional investments such as equities and fixed income. Private equity, real estate, commodities, and infrastructure are examples of alternative vehicles offering unique diversification benefits and the potential for outsized returns.

For instance, real estate can serve as an effective hedge against inflation and economic downturns, providing stable, income-generating opportunities in markets where stocks and bonds may falter. Similarly, commodities can act as a natural inflation hedge, while private equity offers long-term capital appreciation through investments in illiquid assets with high growth potential.

Utilizing Derivatives and Leverage

Derivatives and leverage are integral components of advanced portfolio construction, offering hedge funds the flexibility to manage risk, enhance returns, and adapt to market shifts. Derivatives—such as options, futures, and swaps—provide a versatile set of tools for hedging positions, mitigating downside risk, and gaining exposure to specific asset classes or market movements without directly holding the underlying securities.

Leverage, by amplifying exposure to investment opportunities through borrowed capital, enables hedge funds to magnify both potential gains and losses. While the use of leverage can accelerate capital growth, it requires careful calibration to avoid heightened risk during periods of market volatility. Monitoring key factors such as interest rates, counterparty risk, and overall market conditions is essential to managing leverage effectively.

The Decision-Making Process of Hedge Fund Analysts

Hedge fund analysts use a data-driven approach for informed investment decisions. By integrating market intelligence, financial news, and rigorous analytical methodologies, analysts craft strategic recommendations designed to capitalize on market inefficiencies while managing risk effectively.

Incorporating Market Intelligence and Financial News

Hedge fund analysts monitor a wide range of sources, including macroeconomic reports, geopolitical developments, and industry-specific trends, to identify emerging investment opportunities.

Incorporating advanced analytics tools helps you achieve actionable insights from vast datasets. Leveraging predictive models, machine learning algorithms, and financial technology platforms enhances our ability to forecast market movements with greater precision.

Crafting Investment Recommendations

The process of developing investment recommendations involves the meticulous synthesis of market intelligence, financial data, and performance analytics. Start by thoroughly evaluating the company’s financial health through a detailed analysis of its balance sheets, income statements, and cash flow reports.

Risk assessment remains a cornerstone of the decision-making framework, where you employ scenario analysis and stress testing to evaluate downside risks relative to expected returns.

Tools and Techniques for Competitive Analysis

In the realm of competitive finance, the strategic use of data analysis and advanced technology is paramount for deriving actionable insights and maintaining a competitive edge. A thorough evaluation of historical performance, combined with innovative trend-tracking methodologies, forms the foundation of our analytical approach.

Data Analysis and Actionable Insights

Effective competitive analysis begins with a thorough evaluation of track records and performance metrics. Utilizing benchmarks like the Sharpe ratio helps us assess risk-adjusted returns, allowing for a deeper understanding of a fund’s performance. You can employ Excel and Visual Basic for Applications as detailed in Hedge Fund Modelling and Analysis to streamline complex financial models.

Organizing data into structured formats aids in extracting trends and insights. Focus on identifying patterns in market data to predict future movements, which involves creating financial models to simulate potential outcomes based on varying factors. Keep your analysis precise and data-driven to make properly informed investment decisions.

Technology and Social Media

The integration of cutting-edge technology, including machine learning and big data analytics, significantly enhances your capacity to gather and process extensive datasets. Social media platforms, in particular, provide real-time insights and sentiment analysis, offering a unique perspective on market dynamics and investor behaviors.

Utilizing specialized social media monitoring tools allows you to track influential figures and emerging discussions within the financial community. By synthesizing these contemporary insights with traditional analytical frameworks, you can construct a comprehensive view of the competitive landscape, equipping you to navigate the complexities of the financial markets effectively.

Discover How Daloopa Can Elevate Your Competitive Analysis

In the fast-paced world of hedge fund analysis, Daloopa offers data-driven solutions that streamline your research and enhance decision-making. Explore how our platform can provide the insights you need for more precise competitive analysis. Interested in seeing how it works? Request a demo today to experience Daloopa’s capabilities firsthand.