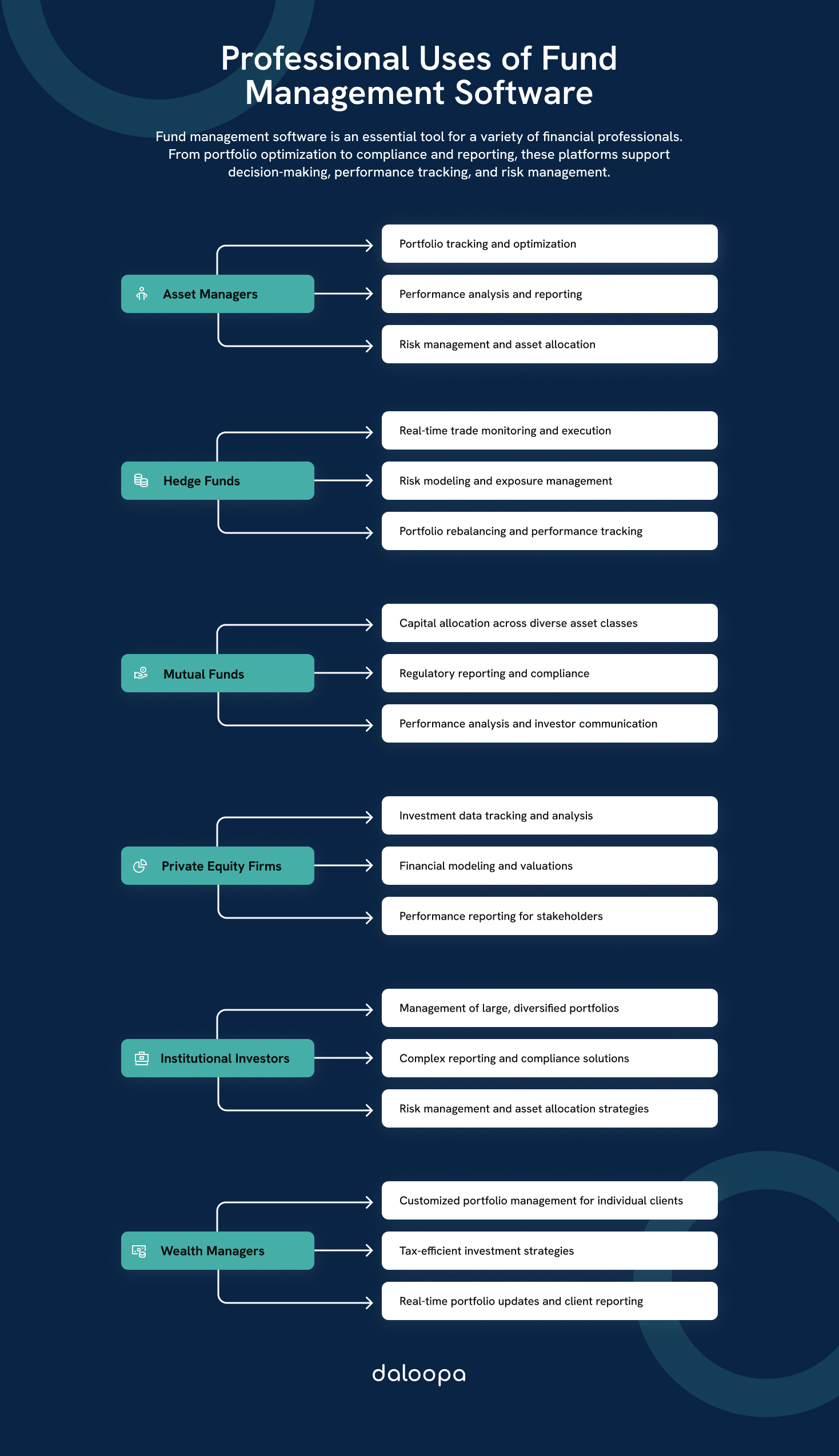

In today’s financial world, fund management software plays an important role for investment firms and financial advisors. It simplifies tasks like tracking investments, managing portfolios, and generating reports. With the right software, you can improve operational efficiency and make more informed decisions, freeing up more time for strategic planning and client relationships.

There is a wide range of fund management software designed to meet different needs. Many of these software solutions offer integrated modular features, including portfolio management, risk assessment, and compliance tracking. Innovative paths for financial management optimization leverage big data and advanced analytics, to deliver real-time insights and predictive capabilities.

A notable trend is the rise of turnkey asset management platforms (TAMPs). These platforms are transforming wealth management, especially in regions like China. By simplifying the complexities of fund management, TAMPs are becoming an appealing option for firms looking to transform their wealth management landscape.

Key Takeaways

- Fund management software enhances operational efficiency and decision-making.

- Integrated modular features offer comprehensive solutions.

- Turnkey asset management platforms simplify complex fund management tasks.

Core Features and Functionalities

Fund management software solutions are designed to streamline various financial processes and enhance decision-making efficiency. Some of their key features include dynamic financial analysis, real-time data integration, portfolio risk management, and comprehensive investor reporting.

Dynamic Financial Analysis

Dynamic financial analysis is essential for fund management. It allows us to assess financial health and forecast future performance by analyzing various financial scenarios. Advanced algorithms in fund management software enable us to simulate market conditions and stress-test portfolios.

Leading fund management platforms, such as Aladdin by BlackRock and SimCorp Dimension, provide powerful tools for this type of analysis. This allows investment bankers to better align their strategies with financial goals even in uncertain market conditions.

These analyses help identify potential risks, optimize asset allocation, and support strategic decision-making. By leveraging robust dynamic financial analysis tools, we can more effectively navigate volatile markets and ensure that investment strategies are in line with our financial goals.

Real-Time Data Integration

Real-time data integration is vital for maintaining an accurate and up-to-date view of portfolios. Fund management software often incorporates real-time feeds from multiple market data providers. This integration ensures that we have access to the latest financial metrics, market movements, and economic indicators.

As a financial analyst, up-to-the-minute information on market trends, security prices, and economic indicators is crucial. Platforms like Bloomberg Terminal and Refinitiv Eikon offer a vast array of real-time data, including stock quotes, foreign exchange rates, bond prices, and news articles. With this information, we can make more informed investment decisions quickly, identify potential investment opportunities, and assess market risks.

For instance, an analyst can use real-time data to monitor a company’s stock price during a merger announcement, assess the impact of a geopolitical event on global markets, or evaluate the effectiveness of a new investment strategy.

Portfolio Risk Management

Portfolio risk management focuses on identifying, assessing, and mitigating risks in the investment portfolio. Fund management software typically includes analytical tools that evaluate risk factors such as market volatility, credit risk, and interest rate changes.

FactSet’s Risk Analytics, for instance, provides real-time tracking of these risk factors. It allows financial analysts and investment bankers to conduct rigorous stress testing of portfolios. This enables them to model potential losses under various market scenarios and proactively adjust investment strategies to mitigate risks and optimize returns.

With these tools we can identify potential vulnerabilities and quantify the impact of adverse events and make informed decisions to enhance risk-adjusted returns. Effective risk management ensures that our investment strategies are resilient. We can swiftly respond to changing market conditions, thereby minimizing losses and maximizing long-term value.

Investor Reporting

Investor reporting features provide transparent and detailed insights into portfolio performance and investment strategies. Fund management software should offer customizable reporting templates that highlight key metrics such as returns, asset allocation, and risk indicators.

This transparency builds trust with investors and helps with client retention. Comprehensive and clear reporting also supports regulatory compliance and enhances overall communication between fund managers and investors.

Top 5 Fund Management Software Providers

When it comes to fund management, selecting the right software provider is crucial. Here, we highlight five of the best solutions available, detailing their unique features and benefits.

BlackRock Aladdin

BlackRock Aladdin stands out due to its comprehensive suite of tools for risk management, portfolio management, and trading. It offers extensive analytics and real-time data integration, making it an invaluable asset for institutional investors.

The platform’s extensive risk analytics capabilities help in monitoring and managing complex portfolios efficiently. Aladdin’s scalability also ensures it can handle growing data and evolving market conditions seamlessly.

Charles River IMS

Charles River Investment Management Solution (IMS) integrates front- and middle-office functions, facilitating a streamlined workflow from portfolio management to compliance and post-trade processing.

This software excels in providing automated investment workflows, ensuring consistent data governance and investment decision support. Its compliance monitoring is top-notch, supporting global regulatory requirements, which makes it a go-to for firms operating in multiple jurisdictions.

SimCorp Dimension

SimCorp Dimension offers a modular setup, allowing firms to customize their software package to meet specific needs. This flexibility ensures that the system grows with the business.

One of the standout features is its comprehensive asset coverage, enabling users to manage multiple asset classes under one roof. Additionally, its strong analytics allow for real-time risk and performance monitoring.

eFront

eFront specializes in alternative investment management, making it ideal for private equity and real estate managers. It provides end-to-end solutions covering front-, middle-, and back-office needs.

The software’s data management capabilities help in maintaining high-quality data, which is crucial for making informed investment decisions. Furthermore, eFront offers robust reporting tools that simplify complex workflows and improve transparency.

FactSet

FactSet is renowned for its rich data integration and reporting capabilities. It facilitates in-depth research and analysis, making it a preferred choice for analysts and portfolio managers.

One of FactSet’s primary strengths is its customizable dashboards, which allow users to tailor data views to their specific needs. Additionally, its collaboration tools enhance team productivity and seamless information sharing.

Benefits of Using Fund Management Software

Fund management software offers several advantages, including the ability to maximize returns, optimize investment strategies, improve portfolio construction, enhance risk management, and streamline investor reporting.

Maximizing Returns

Fund management software assists in identifying high-yield investment opportunities. Using advanced algorithms and big data analytics, the software evaluates historical and real-time market data to forecast trends. This data-driven approach helps portfolio managers make more informed decisions, ultimately aiming for higher returns. Automated rebalancing features can also maintain optimal asset allocation, ensuring sustained performance.

By leveraging machine learning models, fund managers can mitigate human error and emotional biases. This leads to a more disciplined and consistent investment strategy, crucial for achieving long-term financial goals. Additionally, incorporating analytics can provide insights that may be overlooked in traditional fund management methods.

Optimizing Investment Strategies

Sophisticated fund management solutions help in devising robust investment strategies by comprehensively analyzing various asset classes and market conditions. Simulation tools can model different market scenarios, allowing us to test strategies under diverse conditions.

Customizable dashboards enable quick adjustments to strategies based on evolving market data. Moreover, historical performance metrics and predictive analytics guide adjustments, optimizing the portfolio’s performance. Real-time data access ensures prompt responses to changing market conditions, keeping the investment strategy aligned with financial goals.

Improving Portfolio Construction

One significant advantage is the enhanced ability to build diversified portfolios. Fund management software facilitates effective diversification by evaluating correlations between assets. This results in a more balanced and resilient portfolio, reducing the impact of market volatility.

Easy integration with other financial tools and data sources provides a holistic view of asset allocation. Because portfolios can be dynamically adjusted, they remain aligned with both market conditions and investment objectives. Advanced visualization tools offer clear and concise insights into portfolio composition, aiding in decision-making.

Enhancing Risk Management

Effective risk management is critical in fund management. Advanced software solutions bring sophisticated risk assessment tools to the table. Features such as stress testing, scenario analysis, and value-at-risk calculations are essential for identifying potential threats.

The software provides real-time risk monitoring, automatically flagging potential issues. By automating risk assessment, it reduces the possibility of manual errors. Instant alerts and notifications ensure that we can address risk factors promptly. Enhanced risk management leads to a safer investment environment, preserving capital and sustaining growth.

Streamlining Investor Reporting

Keeping investors informed is easier with automated reporting tools. Fund management software generates detailed, customizable reports, making complex data understandable. Reports can be tailored to meet regulatory requirements, ensuring compliance and enhancing transparency.

Incorporating fund management software into our operations can significantly enhance various aspects of fund management, driving better results and improving overall efficiency. This technology offers a robust framework for meeting our investment objectives efficiently and effectively.

Improved Efficiency With Fund Management Software

Using advanced fund management software ensures effective management of investments and risks. Tools like FactSet and Aladdin by BlackRock provide real-time data, detailed financial analysis, and advanced risk management features that help financial analysts and investment bankers make better decisions. These technologies also help with clear reporting, which builds trust with investors and improves communication.

Keep up with industry trends and enjoy up-to-date financial models without doing all the manual work. Learn more about how Daloopa can help improve your investment strategies with solutions tailored to the needs of financial professionals.