From setting up a user-friendly environment to mastering advanced formulas, Excel empowers investment banking analysts to dissect financial data with precision, build reliable models, and make informed decisions.

With knowledge of necessary Excel functions, efficient data management, and pivotal techniques for auditing financial models, investment banking analysts can build robust models to analyze financial performance and trends, ensuring the accuracy and reliability of their insights.

Jump to:

- Setting Up Your Excel Environment for Investment Banking Analysts

- Using Advanced Templates and Pre-Built Models

- Excel Functions for Advanced Financial Analysis

- Advanced Data Management and Auditing in Excel

- Advanced Financial Model Building Methods

- Analyzing Financial Performance and Trends

- Advanced Automation and Integration in Excel for Financial Analysis

- Practical Applications for Decision-Making in Investment Banking

- Portfolio Management

Setting Up Your Excel Environment for Investment Banking Analysts

For investment banking analysts, fine-tuning Excel’s environment aids in managing the complexity and scale of financial models. By incorporating advanced customization techniques, professional add-ins, and robust collaboration tools, you can significantly enhance your efficiency and accuracy.

Advanced Customization for Precision and Performance

Optimizing Excel for financial analysis requires more than simple settings adjustments. Start by configuring Excel’s precision by setting the number of decimal places for calculations and enabling iterative calculations for circular references. For analysts dealing with intricate models, this ensures calculations are as precise as possible.

Custom shortcuts can dramatically speed up repetitive tasks. By assigning keyboard shortcuts to frequently used formulas or formatting options, analysts can navigate their models more quickly and focus on the analysis. Adjust memory allocation, disable resource-heavy features like animations, and fine-tune Excel’s performance settings to reduce lag during complex model processing.

Leveraging Professional Add-Ins for Enhanced Analysis

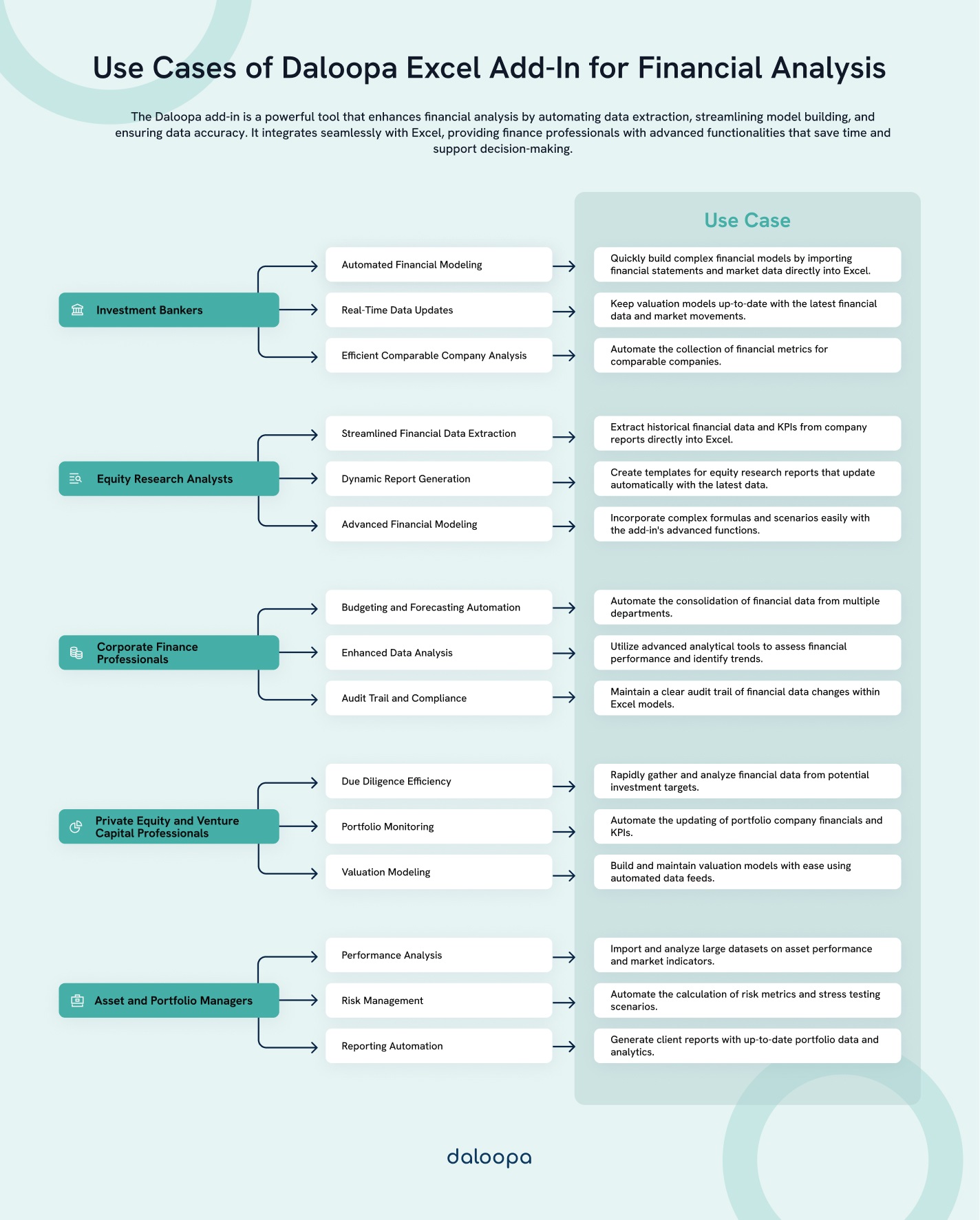

For a more powerful analytical experience, investment banking analysts often rely on specialized Excel add-ins. One such tool, the Daloopa plugin, integrates real-time financial data directly into Excel, allowing for faster updates and accurate financial modeling. Daloopa also enhances data visualization and analysis through advanced statistical tools, helping analysts maintain a competitive edge when working on dynamic financial reports.

Collaboration and Version Control

Having the right tools ensures that team efforts remain synchronized. SharePoint and OneDrive are excellent platforms for real-time collaboration, allowing multiple analysts to work on the same model simultaneously without risking data loss or version conflicts. These platforms also provide version tracking, so it’s easy to restore earlier iterations of a model if necessary.

For more advanced version control, consider using Git alongside Excel. By integrating Git repositories into your workflow, you can create a structured versioning system, track detailed changes, and collaborate with larger teams more effectively. Git’s ability to manage file versions ensures critical changes are properly documented while mitigating the risk of overwriting essential work.

Using Advanced Templates and Pre-Built Models

For investment banking analysts, utilizing advanced financial modeling templates significantly enhances productivity while ensuring the accuracy and consistency of your work. These sophisticated models provide a reliable foundation for analyzing complex financial transactions, allowing analysts to focus on strategic decision-making rather than repetitive tasks.

Accessing Sophisticated Financial Modeling Templates

When analyzing intricate financial transactions such as leveraged buyouts (LBOs), mergers and acquisitions (M&A), or project finance deals, starting with advanced, industry-standard templates can save time and minimize errors. These templates are pre-structured to include balance sheets, income statements, cash flow projections, and sensitivity analyses—tailored for each specific type of transaction.

Here are key resources for accessing advanced templates:

- LBO Models: Used for analyzing the viability of leveraged buyout deals, focusing on debt structuring and equity returns.

- M&A Models: Designed to evaluate deal structures, synergies, and accretion/dilution analysis to understand the financial impact of mergers and acquisitions.

- Project Finance Models: Tailored for long-term infrastructure and capital-intensive projects, incorporating cash flow waterfalls and risk analysis.

These templates come with built-in financial logic and formulas customized to meet the unique requirements of each transaction type. By starting with these sophisticated models, analysts can ensure consistency and accuracy throughout the analysis while saving time on model setup.

Best Practices in Model Auditing and Standards

Adopting best practices like model auditing and adherence to recognized modeling standards is critical to maintaining reliability in financial analysis. Model auditing involves rigorously checking your financial models for errors in formulas, inputs, and assumptions. Tools like Excel’s Trace Precedents and Trace Dependents can help identify discrepancies in complex calculations, ensuring your model is error-free and logically sound.

In addition to auditing, investment banking analysts benefit from following established modeling standards, such as the FAST Standard (Flexible, Appropriate, Structured, Transparent) or the Modano Modeling Standard. These standards enforce a disciplined structure for model layout, naming conventions, and formula logic, making the models easier to review, share, and update. Adhering to these standards also improves model transparency and reduces the risk of errors, ensuring that your models meet the high expectations of clients and colleagues.

Leveraging Version Control for Financial Models

Version control systems, like Git, and collaboration platforms, such as SharePoint, can help track changes to financial models, allowing analysts to roll back to previous versions when necessary easily, ensuring that all changes are properly documented, promoting accountability, and providing a clear audit trail.

Version control also mitigates the risk of overwriting critical data or losing important updates, vital in high-pressure environments like investment banking. By using these systems, teams can collaborate more effectively, ensuring that everyone works on the latest version of the model without risking inconsistencies.

Ensuring Consistency and Accuracy with Pre-Built Models

Beyond advanced templates, pre-built financial models offer a strong starting point for analysts, providing the necessary structure and formulas to comply with best practices and industry standards. These models often incorporate advanced logic and formatting, adhering to standards like the FAST Standard, ensuring a solid foundation for financial analysis.

Pre-built models from reputable sources like CFA Institute, Wall Street Prep, or specialized financial modeling platforms are tailored to address the complexities of specific financial environments. By customizing these models to reflect your company’s unique financial structure, you can ensure a high level of accuracy while saving significant time on model development. These models allow you to confidently present financial analyses, knowing that the underlying structure adheres to the highest standards in the industry.

Excel Functions for Advanced Financial Analysis

Mastering Excel’s financial functions are integrated into models like discounted cash flow (DCF) valuations, leveraged buyout (LBO) models, and sensitivity analyses. Let’s explore how key Excel functions are applied in advanced scenarios and highlight the potential for custom and dynamic functions.

Time Value of Money Functions in Discounted Cash Flow (DCF) Valuations

Investment banking analysts regularly use Excel’s time value of money functions to assess the present worth of future cash flows in DCF valuations.

- PV (Present Value): This function is central in DCF models, as it discounts projected future cash flows back to their present value, adjusting for risk and the cost of capital.

- Example: Imagine an investment with expected cash inflows of $1 million annually over five years and a discount rate of 10%. Using the PV function, an analyst can calculate the present value of these future cash flows, determining whether the investment is financially viable.

- NPV (Net Present Value): NPV goes further by handling uneven or irregular cash flows over time. It sums the present value of each cash flow, allowing analysts to account for more complex payment structures.

- Example: In a valuation of a project with irregular cash inflows, NPV calculates whether the total present value of future cash flows exceeds the initial investment, guiding investment decisions.

For more on these functions, consult Microsoft’s official documentation on PV and NPV.

Loan and Mortgage Functions in LBO Models

Excel’s loan functions provide the tools to structure and analyze debt repayment schedules.

- PMT (Payment), IPMT (Interest Payment), PPMT (Principal Payment): These functions allow analysts to break down monthly loan payments into interest and principal, facilitating the forecasting of cash flows post-debt servicing.

- Example: In an LBO scenario with $6 million in debt financing for a $10 million acquisition, IPMT and PPMT can be used to calculate interest and principal payments over time, providing insights into debt repayment’s impact on cash flow.

Advanced Usage: Array Functions and Dynamic Arrays

Dynamic arrays, introduced in newer versions of Excel, allow analysts to perform complex calculations across multiple cells without manual input, improving efficiency in large-scale models.

- XNPV and XIRR: These dynamic functions are invaluable when cash flows are irregular, such as in project finance models or real estate investments.

- Example: In a project finance model where cash inflows and outflows don’t follow a fixed schedule, XNPV calculates the net present value based on specific dates, while XIRR computes the internal rate of return, giving a precise reflection of project profitability.

For more advanced usage, check out Microsoft’s XIRR guides.

VBA and Custom Functions

When Excel’s built-in functions don’t suffice for complex financial modeling, investment banking analysts turn to VBA (Visual Basic for Applications) to create custom functions. These custom tools can handle specialized calculations or automate repetitive tasks, enhancing efficiency and precision.

- Custom VBA Functions: VBA allows analysts to develop bespoke functions tailored to unique financial products or non-standard calculations.

- Example: In a merger scenario, an analyst creates a custom VBA macro that dynamically updates multiple DCF valuations based on varying inputs from sensitivity analyses, providing real-time insights into different strategic outcomes.

For those interested in learning VBA, this Microsoft VBA tutorial offers an in-depth guide to building custom solutions.

Model Auditing and Best Practices

Ensuring the accuracy of financial models is crucial, and Excel’s auditing tools make it easier to identify and fix errors.

- Auditing Tools: Tools like Trace Precedents and Trace Dependents map the relationships between cells, helping analysts spot broken links or miscalculations.

- Example: Before presenting a DCF model to a client, an analyst uses these auditing tools to ensure that all formulas are correctly linked to the underlying assumptions, improving the model’s reliability.

Following industry standards like the FAST Standard (Flexible, Appropriate, Structured, Transparent) or Modano Modeling Standard further enhances model transparency and auditability.

Version Control and Collaboration

Using platforms like SharePoint, OneDrive, or Git for Excel enables teams to track changes, avoid overwriting work, and maintain a structured model versioning system.

- Version Control: Git or SharePoint allows analysts to maintain a clear audit trail of model changes, providing transparency and accountability throughout the project lifecycle.

- Example: A team working on an M&A transaction uses Git to manage updates to their LBO model, ensuring that every team member works from the latest version without risking data loss or inconsistencies.

External Resources for Mastery

For in-depth understanding and continuous improvement, it’s important to stay updated with advanced tutorials and official Microsoft documentation:

By incorporating these advanced Excel functions, customization techniques, and best practices, analysts can create robust and audit-ready financial models that withstand scrutiny in high-stakes environments.

Advanced Data Management and Auditing in Excel

For investment banking analysts, managing large datasets and ensuring data integrity is critical in developing accurate financial models. Utilizing advanced Excel tools like Power Query and Power Pivot, coupled with robust data validation techniques and external data integration, significantly enhances the efficiency and accuracy of financial analysis. Here’s how to handle these challenges effectively.

Handling Large Datasets with Power Query and Power Pivot

Traditional Excel methods can become inefficient when managing large datasets. Tools like Power Query and Power Pivot offer powerful capabilities to streamline data handling and analysis.

- Power Query: Power Query simplifies the process of importing, cleaning, and transforming data from multiple sources with minimal manual effort, allowing analysts to automate repetitive tasks such as filtering, sorting, and merging datasets, ensuring data consistency across financial models.

- Example: An analyst working on a merger model can use Power Query to connect to various databases (e.g., SQL Server or CSV files), clean the data, and load it into their model, saving time and ensuring the accuracy and freshness of the data.

- Power Pivot: Power Pivot enables the creation of more complex data models, allowing analysts to merge large datasets from different sources without overloading Excel’s traditional functionalities. It also supports the development of calculated fields and key performance indicators (KPIs), enhancing the depth of financial analysis.

- Example: For a merger analysis, Power Pivot allows an analyst to combine revenue data from multiple divisions, calculate synergies, and model future cash flows without bogging down Excel’s performance.

Advanced Data Validation Techniques

Excel’s data validation tools help analysts enforce consistent data entry, preventing invalid data from skewing the results.

- Data Validation Rules: Data Validation rules restrict data entry to specified formats or ranges. For instance, you can set rules to allow only numeric values between a specific range, like interest rates from 0% to 20% or dates within a predefined period.

- Example: An LBO model might use data validation to ensure that all input values for discount rates or EBITDA multiples fall within industry-accepted ranges, reducing the risk of incorrect assumptions.

- Conditional Formatting: The Conditional Formatting tool automatically highlights data that falls outside predefined thresholds, making it easier to identify anomalies in financial projections.

- Example: In a sensitivity analysis, an analyst can use conditional formatting to flag scenarios where projected cash flows drop below a critical threshold, helping quickly pinpoint potential issues in the model.

Connecting to External Data Sources

In modern financial analysis, integrating real-time data from external sources builds accurate and dynamic financial models. Excel’s ability to connect with external databases and financial platforms significantly streamlines this process.

- SQL Server and Access Integration: Many financial analysts must pull data from large, company-maintained SQL databases or Access files. Excel allows you to establish data connections to these sources, ensuring that your financial models always use the most current information.

- Example: An analyst modeling a large infrastructure project connects to a SQL database to retrieve daily updates on financial metrics. Using Power Query, they can automate the data refresh process, ensuring that their model reflects real-time financial data without manual intervention.

- Bloomberg and Reuters Integration: Financial platforms like Bloomberg and Reuters provide essential market data that can be directly integrated into Excel. Using the Excel add-ins provided by these platforms, analysts can pull live data such as stock prices, bond yields, and foreign exchange rates into their models for real-time analysis.

- Example: In an equity research report, an analyst may use the Bloomberg Excel add-in to import real-time stock price data, ensuring that their DCF valuation remains up-to-date with the latest market conditions.

Auditing Large Models for Accuracy and Integrity

As financial models grow in complexity, the risk of errors increases. Excel offers several auditing tools to help analysts maintain the integrity of their models.

- Trace Precedents and Dependents: These tools visually map the relationships between cells, making it easy to trace the flow of data through a model and verify that all links are accurate.

- Example: Before finalizing a capital project model, an analyst can use Trace Precedents to ensure that all revenue projections and discount rate assumptions are correctly linked and flow through the model accurately.

- Error Checking and Review: Excel’s error-checking tools automatically highlight potential issues such as circular references or inconsistent formulas. Third-party tools like IDEA or Audit Excel can also be used for thorough audits on larger, more complex models.

- Example: An M&A model might use these tools to identify any broken links or incorrect formulas before presenting the final valuation to clients, ensuring the model’s integrity.

Routine Data Audits and Integrity Checks

Regular data audits and integrity checks are essential to ensuring that your financial models remain accurate over time. Establishing automated processes for error checking can help catch potential issues early.

- Routine Audits: Analysts should schedule regular audits to check both data inputs and formulas. This might involve using Excel’s built-in auditing features or creating custom VBA macros to automate checks across large datasets.

- Example: An investment banking team working on a large LBO model sets up automated VBA checks to ensure that input values such as EBITDA, interest rates, and discount factors fall within acceptable ranges.

- Error-Checking Mechanisms: Functions like IFERROR and ISNUMBER allow analysts to catch invalid data entries in real time, alerting them to potential issues before they impact the model.

- Example: Embedding IFERROR in a DCF model helps prevent the model from breaking when encountering missing or incorrect data, ensuring a smoother analysis process.

By leveraging Excel’s Power Query and Power Pivot for handling large datasets, integrating external data sources, and applying advanced validation and auditing techniques, investment banking analysts can manage complex financial models with greater efficiency, ensuring accuracy and reliability even in high-stakes environments.

Advanced Financial Model Building Methods

In investment banking, building financial models goes beyond basic financial statement creation. Analysts rely on advanced modeling techniques to structure complex models for scenarios like leveraged buyouts (LBOs), mergers and acquisitions (M&A), and multi-scenario forecasting. Effective model structuring, circular reference handling, and the use of flags ensure models remain efficient, accurate, and insightful.

Structuring Financial Models

Adhering to best practices for model structuring is crucial for minimizing errors, ensuring clarity, and streamlining the auditing process.

- Modular Design: Organize your model into clear, logical sections (e.g., Assumptions, Calculations, Outputs) to maintain clarity and allow for easy navigation. For example, start with an Assumptions tab, followed by detailed Calculation tabs, and end with Output or Summary tabs that consolidate key insights into financial statements. This helps users trace inputs and outputs efficiently.

- Consistent Formatting: Adopting a standardized format for inputs, calculations, and outputs improves readability. Common practices include using blue for inputs, black for formulas, and green for links, which ensures consistency across models, especially when collaborating with other analysts.

- Flags and Switches: Use flags to control key decisions or trigger actions in the model. For example, in an LBO model, you could implement a flag that triggers when the company’s debt service coverage ratio (DSCR) falls below a certain threshold, automatically adjusting future cash flows and debt repayment assumptions.

- Handling Circular References and Iterative Calculations: Circular references often arise in complex models, especially in scenarios like interest expense calculations, where interest depends on debt balances, which in turn depend on net income. To resolve this, enable iterative calculations in Excel (under File > Options > Formulas), allowing Excel to resolve these loops without generating errors.

Complex Financial Models: M&A, LBO, and Multi-Scenario Forecasting

Investment banking analysts often build highly complex models, such as merger models, LBO models, and multi-scenario forecasting models, which involve detailed financial projections and advanced assumptions.

- Merger Models: In an M&A model, analysts project the financial performance of two companies post-merger. Key components include synergies, accretion/dilution analysis, and purchase price allocation (PPA). Deal structure assumptions (cash vs. stock) and their impact on earnings per share (EPS) must also be factored in.

- Example: Build a pro forma income statement that merges both companies’ financials, incorporating revenue synergies and cost savings. Use flags to toggle between different deal structures and assess the overall impact on EPS and shareholder value.

- Leveraged Buyout (LBO) Models: LBO models assess the feasibility of acquiring a company primarily through debt. They involve building multiple layers of debt tranches, interest schedules, and amortization profiles, carefully examining cash flow projections to ensure the company can meet its debt obligations.

- Example: In an LBO model, create multiple exit scenarios (e.g., a 3-year or 5-year exit) and adjust EBITDA growth or interest rate assumptions to analyze how different conditions affect the internal rate of return (IRR) for the equity sponsors.

- Multi-Scenario Forecasting: Multi-scenario forecasting models allow analysts to assess various potential outcomes by adjusting key drivers such as revenue growth, cost inflation, or interest rates.

- Example: In a project finance model, create base, upside, and downside cases with scenario switches to toggle between them. Utilize Excel’s data tables to dynamically show how key financial metrics, like net present value (NPV) or debt coverage ratios, shift under different scenarios, such as fluctuating commodity prices or interest rates.

Advanced Techniques for Model Auditing

Ensuring the accuracy of complex financial models is crucial, especially when large sums of capital are involved. Implementing advanced auditing techniques can help catch errors early and ensure the model’s robustness.

- Error Checks and Balancing Mechanisms: Build in checks to verify the integrity of the model, such as ensuring the balance sheet balances or cash flows reconcile across financial statements.

- Example: In an LBO model, incorporate checks to confirm that total debt balances align with cash flow projections and that interest expenses are accurately linked to outstanding debt levels.

- Version Control Best Practices: Use version control tools to manage model changes and collaboration between analysts. Platforms like Git, SharePoint, or OneDrive can help track revisions and maintain an audit trail.

- Example: Use Git to track updates to critical assumptions, such as changes in macroeconomic factors or capital structure adjustments, ensuring that every change is documented and easily reversible.

Advanced Financial Modeling Techniques: Monte Carlo Simulations and Risk Analysis

Advanced financial modeling requires robust tools and techniques that enable analysts to perform detailed risk analysis, forecasting, and scenario planning. Methods like Monte Carlo simulations, Value at Risk (VaR) calculations, and stress testing provide a comprehensive framework for evaluating uncertainties and making data-driven decisions in finance.

Monte Carlo Simulations: A Step-by-Step Guide

Monte Carlo simulations allow analysts to model the probability of various outcomes through random sampling, making this technique particularly useful for risk analysis in complex financial models.

- Define Key Variables: Identify the uncertain factors in your model, such as interest rates, sales growth, or market volatility.

- Example: If you’re forecasting future revenue, the growth rate might fluctuate between 2% and 6%. You need to model different possible outcomes based on these variations.

- Generate Random Inputs: Use Excel functions like RAND() or NORM.INV() will generate random inputs for these variables.

- RAND(): Produces a random number between 0 and 1, ideal for simple simulations.

- NORM.INV(probability, mean, standard_dev): Generates a normally distributed random variable based on historical data.

- Example: For forecasting revenue growth, use =NORM.INV(RAND(), 0.04, 0.01) to generate a growth rate with a mean of 4% and a standard deviation of 1%.

- Run the Simulation: Feed these random variables into your financial model, such as projecting future revenues and costs.

- Example: Multiply random growth rates by current revenue to project future outcomes over different iterations.

- Repeat Iterations: Utilize Excel’s Data Table feature to run thousands of iterations. This will simulate a range of outcomes based on your random inputs.

- Example: Run 10,000 iterations of revenue forecasts by randomly varying the growth rate in each iteration.

- Analyze Results: Summarize your findings using statistical measures like the mean, median, and standard deviation. Visualize the data with histograms or probability distributions to evaluate likely scenarios and potential risks.

- Example: After completing the simulation, assess the distribution of revenue outcomes to determine the probability of meeting or exceeding certain revenue targets.

Monte Carlo simulations are commonly applied in areas such as project finance, option valuation, and any scenario involving high levels of uncertainty. By modeling potential outcomes, analysts can better assess risks and opportunities.

Risk Analysis: Value at Risk (VaR) and Stress Testing

In addition to simulations, risk analysis often involves more direct methods like VaR calculations and stress testing to evaluate financial stability under varying conditions.

Value at Risk (VaR)

VaR measures the maximum expected loss of an investment or portfolio over a given time period at a specific confidence level. It is a widely used tool for risk management in investment banking.

- Methodology: VaR can be calculated using historical data, parametric models (which assume normal distribution), or Monte Carlo simulations.

- Example: For a $1 million portfolio, if a 95% VaR calculation indicates a potential loss of $50,000 over the next month, this means there is a 95% chance the portfolio will not lose more than $50,000 during that period.

Stress Testing

Stress testing evaluates how a financial model would perform under extreme or adverse conditions, such as a market crash, economic recession, or sudden spike in interest rates.

- Methodology: Modify key variables in your model to simulate worst-case scenarios. Adjust factors like interest rates, revenue growth, or debt repayment obligations to reflect severe market conditions.

- Example: In an LBO model, simulate a scenario where interest rates increase by 2%. Analyze the impact this would have on the company’s ability to service its debt and maintain liquidity. Ensure the model can withstand these financial shocks without triggering a default.

Data Handling with Power Query and Power Pivot

Managing large datasets in complex financial models requires efficient tools. Excel’s Power Query and Power Pivot enhance data management and modeling capabilities.

- Power Query: Enables users to import, clean, and transform data from various external sources like databases (e.g., SQL Server, Access) or financial platforms (e.g., Bloomberg, Reuters).

- Example: Use Power Query to pull monthly stock data from Bloomberg, clean it by removing duplicates, formatting dates, and filling in missing values, ensuring your financial model uses accurate and up-to-date data.

- Power Pivot: Extends Excel’s data modeling functions, allowing users to link large datasets, build relationships between data tables, and perform advanced calculations.

- Example: Use Power Pivot to link financial data from different departments (e.g., revenue projections and expense forecasts) and perform detailed analysis on how external factors, such as industry trends, impact overall financial performance.

Data Validation and Integrity Checks

Ensuring data accuracy is critical when dealing with financial projections, especially for high-stakes decisions. Excel offers several features that help maintain the integrity of your models.

- Data Validation: Use Excel’s data validation rules to restrict data entry to specific ranges or types, preventing erroneous inputs.

- Example: For projected revenue growth, set a validation rule that limits inputs to a 1%-10% range. This prevents unrealistic or outlier data from skewing results.

- Error Checking and Conditional Formatting: Implement error checks and conditional formatting to flag potential anomalies or outliers in your data.

- Example: Apply conditional formatting to highlight negative growth rates in revenue projections, indicating either a data entry error or an unexpected business risk that warrants further analysis.

External Resources for Further Learning

To enhance your understanding of advanced financial modeling techniques, including Monte Carlo simulations, risk analysis, and Excel-based modeling, consider the following expert resources:

- “Advanced Modelling in Finance Using Excel and VBA” by Mary Jackson and Mike Staunton

This book provides an in-depth guide to advanced financial models using both Excel and VBA. It covers topics like portfolio optimization, option pricing, and simulations.

Available on Amazon: Advanced Modelling in Finance Using Excel and VBA - Coursera: “Financial Engineering and Risk Management” by Columbia University

This online course covers advanced techniques in financial modeling, including simulations, stress testing, and risk management strategies.

Course Link: Financial Engineering and Risk Management

By engaging with these advanced resources, you can refine your financial modeling skills and stay updated with the latest tools and techniques in the industry.

Analyzing Financial Performance and Trends

In investment banking and corporate finance, accurately analyzing financial performance and forecasting future trends requires advanced analytical techniques and cutting-edge data visualization. By utilizing sophisticated forecasting models, time-series analysis, and integrating powerful tools like Power BI, financial professionals can gain deeper insights and provide actionable recommendations.

Advanced Forecasting and Budgeting Strategies

Financial forecasting goes beyond simple linear projections. By applying advanced time-series models such as ARIMA (AutoRegressive Integrated Moving Average) and exponential smoothing in Excel, you can refine the accuracy of your predictions. These models are particularly effective in analyzing time-dependent data like stock prices, revenue, or sales figures. Excel’s Data Analysis Toolpak and built-in functions like FORECAST.ETS allows users to implement these models for predictive analysis.

- ARIMA Models: ARIMA models are highly useful when analyzing data that shows patterns over time. This method helps analysts account for trends, seasonality, and irregularities, making it a preferred choice for stock price forecasting or long-term sales predictions.

- Example: An investment analyst can forecast the next quarter’s stock prices using ARIMA in Excel by setting the model to capture both short-term volatility and long-term trends.

- Exponential Smoothing: This method smooths out fluctuations in the data, making it easier to identify long-term trends by giving greater weight to recent data points.

- Example: When analyzing a company’s monthly sales data, exponential smoothing can highlight a downward or upward trend, helping the finance team make better budgeting decisions.

To further enhance forecasting, Scenario Analysis using Excel’s Data Tables and Scenario Manager allows the simulation of various financial outcomes, ranging from best-case to worst-case projections. This approach ensures that companies maintain a dynamic and adaptive financial plan capable of navigating potential challenges or seizing opportunities.

Time-Series Analysis and Pattern Recognition

Time-series analysis helps detect patterns in historical financial data that may not be evident at first glance. Advanced methods like moving averages, exponential smoothing, and ARIMA models allow analysts to uncover trends or cycles, such as seasonal revenue fluctuations or recurring cash flow patterns.

- Moving Averages: Analysts can use moving averages to smooth data and identify long-term trends by calculating the average of a set period.

- Example: A financial analyst might apply a 12-month moving average to revenue data to eliminate noise and better understand long-term performance.

- Pattern Recognition: Excel’s Data Analysis Toolpak can be used to recognize patterns such as increasing volatility in stock prices or profitability cycles over time.

- Example: A financial team analyzing cash flows could use ARIMA models to predict future fluctuations based on past trends, helping them prepare for periods of high or low liquidity.

By applying conditional formatting in Excel, analysts can quickly identify significant deviations from historical averages or highlight emerging trends. For instance, analysts can color-code cells where revenue growth falls below a certain threshold, signaling a potential risk to business performance.

Risk Analysis with Monte Carlo Simulations and Value at Risk (VaR)

For investment banking professionals, understanding risk is paramount. Monte Carlo simulations and Value at Risk (VaR) calculations are vital tools in quantifying uncertainties and evaluating potential outcomes.

- Monte Carlo Simulations: Excel’s ability to run Monte Carlo simulations—using functions like RAND() and NORM.INV()—enables financial professionals to model the impact of uncertainty by running thousands of iterations.

- Example: When forecasting a project’s future cash flows, an analyst can simulate a range of possible outcomes by varying key drivers like interest rates or sales growth. The results show the probability of different cash flow scenarios, offering a deeper understanding of potential risks.

- Value at Risk (VaR): VaR quantifies the potential loss a portfolio or investment might face over a specific period, given a certain confidence level. Excel add-ins like Palisade’s @RISK provide enhanced capabilities to calculate VaR and run advanced Monte Carlo simulations, making it easier to understand a portfolio’s exposure to risk.

- Example: For a portfolio valued at $2 million, an analyst might use VaR to estimate the maximum expected loss over a one-month period at a 95% confidence level, helping managers make informed risk mitigation decisions.

Dashboards and Data Visualization with Power BI

While Excel offers powerful visualization tools, integrating it with Power BI provides a more dynamic and sophisticated approach to dashboard creation. Power BI allows seamless connection to large datasets and external financial data sources, offering advanced data aggregation and visualization features.

- Interactive Dashboards: Power BI enables the creation of real-time, interactive dashboards that consolidate performance metrics, KPIs, and financial trends.

- Example: An investment bank might use Power BI to pull in data from SQL Server, Bloomberg, or Reuters via Power Query, combining historical financial data with real-time market information. This results in an intuitive dashboard displaying stock performance, market volatility, and revenue trends across regions.

- Advanced Data Integration: Power BI, integrated with Excel’s Power Pivot and Power Query, allows for complex, multi-dimensional data analysis. Analysts can link multiple data sources, run advanced calculations, and visualize relationships between financial metrics to uncover deeper insights.

- Example: A corporate finance team could analyze data from various business units, combining revenue projections with external economic indicators to forecast overall company performance. These insights can be presented in an interactive Power BI dashboard, making it easier to communicate results to stakeholders.

By mastering these advanced financial analysis techniques in Excel and leveraging external tools like Power BI, analysts can improve their ability to forecast, manage risks, and identify crucial trends. For more in-depth resources on these methods, check out:

- “TIME SERIES ANALYSIS AND FORECASTING IN EXCEL WITH EXAMPLES” by Satyajit Pattnaik:

Learn how to implement time-series forecasting models in Excel.

Available at: YouTube - “Monte Carlo Simulations in Excel” from Investopedia:

A guide to performing Monte Carlo simulations in Excel for risk assessment.

Available at: Investopedia Monte Carlo Simulations - “Financial Modeling with Power BI” on Udemy:

A course that covers building financial dashboards using Power BI and Excel integration.

Available at: Udemy Power BI Financial Modeling

Advanced Automation and Integration in Excel for Financial Analysis

Incorporating advanced VBA programming and API integration with Excel enables financial professionals to streamline their workflow, automate repetitive tasks, and enhance data accuracy. This section focuses on these advanced techniques to help you take your financial modeling to the next level.

Advanced VBA Programming for Workflow Optimization

Visual Basic for Applications (VBA) allows Excel users to go beyond simple tasks by creating complex macros, custom user-defined functions (UDFs), and even fully functional Excel add-ins tailored to specific financial operations.

- Complex Macros: While basic macros automate simple tasks like formatting or data entry, advanced macros can tackle more sophisticated operations. For instance, you could program a macro to:

- Automate financial reports: Pull data from multiple workbooks or databases, consolidate it, and generate a polished report in one step.

- Update large datasets: Automatically update financial models with the latest data from external sources.

- Link models: Macros can also synchronize different models by pulling and pushing data between them.

- Example: A finance team could automate a weekly process where Excel collects market data, consolidates it across departments, and generates a performance summary—all triggered by a single click.

- User-Defined Functions (UDFs): UDFs allow users to create customized formulas that extend Excel’s built-in functions. UDFs are particularly useful in financial modeling for automating calculations that require more sophisticated logic than what default Excel formulas offer.

- Example: A UDF can calculate complex financial metrics, such as tax shields, debt covenants, or industry-specific ratios, enabling finance teams to perform specialized analyses without manual intervention.

- Excel Add-ins: Creating Excel add-ins using VBA transforms these custom tools into reusable, shareable resources for teams. Financial professionals can build add-ins that integrate frequently used functions, automating repetitive tasks and ensuring consistency across financial models.

- Example: An Excel add-in might include custom menus for financial KPIs, ensuring that all users in a department follow the same calculation methods when evaluating company performance.

For those looking to deepen their VBA expertise, “Professional Excel Development” by Bullen, Green, and Bovey is a must-read. It provides comprehensive insights into creating maintainable, professional-grade VBA applications tailored to financial analysis.

Automation with APIs: Direct Data Integration into Excel

In finance, timely access to data is critical. Integrating Excel with external data sources through Application Programming Interfaces (APIs) allows real-time data retrieval, automating the pulling of information from databases and ensuring that models are always up to date.

Using VBA to connect to APIs, you can automate data extraction from financial databases like Bloomberg, Reuters, or internal company systems.

- Real-Time Data: Automatically pull market data, stock prices, or financial statements into Excel without manual input.

- Example: Use VBA to pull real-time stock prices from Bloomberg every 30 minutes, feeding the data into an options pricing model for instant recalculations.

- Accounting Systems Integration: You can program Excel to retrieve live financial data (e.g., revenue, expenses, cash flows) from internal accounting systems to update budgets, forecasts, or financial statements automatically.

- Example: A macro could automatically extract monthly revenue and expense figures from a company’s accounting database, refresh financial projections, and generate updated cash flow statements.

This integration saves time, minimizes human error, and ensures that financial models always reflect the most current data.

Automating Financial Analysis with Data Tables and PivotTables

Excel’s Data Tables and PivotTables are essential tools for analyzing large datasets, particularly in financial modeling.

- Data Tables: They enable dynamic calculations across varying input ranges, crucial for sensitivity analysis and scenario modeling. By altering input assumptions, financial analysts can quickly gauge the impact on metrics like profit margins, earnings per share, or return on investment.

- Example: An analyst could use a data table to explore the effect of different discount rates on a company’s net present value (NPV), instantly seeing how changes in assumptions affect the model.

- PivotTables: These are perfect for summarizing large datasets, making them invaluable for variance analysis, comparing historical financial data, or dynamically building profit and loss (P&L) statements.

- Example: Analyzing a company’s multi-year performance can be streamlined by using PivotTables to group data by year, department, or region, instantly visualizing performance trends or anomalies.

When combined with VBA, PivotTables and Data Tables can be automated to refresh with new data imports. For instance, a VBA script could:

- Example: Automatically update a sales performance PivotTable with new monthly data and regenerate corresponding charts and reports.

Advanced Data Visualization with Power BI Integration

While Excel’s built-in charting features are powerful, integrating it with Power BI allows for more advanced, interactive data visualization. Power BI can handle larger datasets and perform sophisticated analyses, making it an ideal tool for building dashboards that provide real-time insights into financial performance.

- Interactive Dashboards: Power BI enables the creation of dynamic, real-time dashboards that consolidate financial metrics, KPIs, and scenario outcomes.

- Example: An investment banking team could use Power BI to pull real-time financial data from external platforms and visualize it through interactive waterfall charts, heatmaps, and KPIs. Stakeholders can drill down into specific financial metrics for deeper analysis.

- Data Integration: Excel’s Power Query and Power Pivot enable seamless data import from multiple sources, which can then be analyzed within Power BI to generate insightful, layered visualizations.

- Example: Pulling financial statements from SQL Server into Excel and then using Power BI to create interactive visual reports that compare performance metrics across different business units.

This integration not only enhances data clarity but also enables more effective communication with stakeholders by turning complex financial data into accessible, intuitive visuals.

External Resources for Advanced Excel Automation and Integration

For those looking to enhance their skills in Excel automation, VBA programming, and data integration, here are some free articles and resources that provide detailed tutorials and insights:

- “A Complete Guide to Excel PivotTables” by HubSpot

This article provides an in-depth guide to using PivotTables for data summarization and analysis, offering tips for creating dynamic financial reports.

Read here: Guide to PivotTables. - “Advanced Excel VBA Programming and Macros” by Excel Campus

An excellent resource for mastering advanced VBA programming techniques, including how to create complex macros, automate workflows, and build user-defined functions.

Watch here: Advanced VBA Programming.

These resources will provide you with the knowledge needed to automate workflows, integrate data sources, and utilize advanced tools to optimize your Excel financial models.

Practical Applications for Decision-Making in Investment Banking

Excel remains a cornerstone for financial modeling in investment banking, corporate finance, and equity research. From mergers and acquisitions (M&A) to IPO valuations and portfolio management, these models provide key insights for decision-making. Let’s explore how Excel models drive results in these sectors with real-world applications and actionable examples.

Investment Banking

In investment banking, financial models are critical for evaluating transactions, particularly in mergers and acquisitions (M&A). Two of the most commonly used models include accretion/dilution analyses and synergy models:

- Accretion/Dilution Analysis: This model helps determine whether an acquisition will increase (accretive) or decrease (dilutive) the acquiring company’s earnings per share (EPS). For example, if a company is considering purchasing a smaller competitor, an analyst might model the deal’s impact on EPS by factoring in the financing method (cash, stock, or debt), the acquisition premium, and post-deal earnings. Accretive deals are favorable as they improve shareholder value, while dilutive deals might suggest a longer payback period.

- Synergy Models: Synergy models help estimate the cost savings and revenue enhancements from combining two companies in an M&A deal. By forecasting post-merger efficiencies in operations (e.g., shared R&D resources or reduced overhead), analysts can more accurately assess the overall benefits. This model is then integrated with the accretion/dilution analysis to provide a comprehensive picture of how the deal impacts shareholders.

- IPO Valuation Models: Excel is used to build Initial Public Offering (IPO) valuation models that forecast potential share prices for companies planning to go public. These models typically involve projecting the company’s revenue growth, profit margins, and capital expenditures. Analysts also perform comparable company analysis (comps) and precedent transactions to ensure that their valuation aligns with market conditions.

Equity Research

Equity research analysts use Excel to build dynamic models that allow for the analysis of various financial scenarios. These models adjust automatically based on changes in key assumptions, offering a detailed picture of a company’s future performance:

- Dynamic Financial Models: For example, an analyst forecasting a company’s earnings might use a dynamic model to automatically update projections based on changes in assumptions like interest rates, inflation, or product demand. This allows for flexible and responsive reporting, which is crucial in volatile markets.

- Scenario and Sensitivity Analysis: To enhance their forecasts, equity analysts perform sensitivity analyses that demonstrate how different variables affect a stock’s valuation. For instance, how would a sudden spike in commodity prices impact a company reliant on raw materials? This analysis provides multiple investment scenarios, which are then presented in research reports to help clients make informed decisions about buying or selling stock.

Corporate Finance

In corporate finance, Excel models serve as the backbone for budgeting, forecasting, and strategic financial planning. Professionals use comprehensive financial projection models to guide decisions:

- Full Financial Projections: These models include detailed income statements, balance sheets, and cash flow forecasts, often stretching several years into the future. For example, a corporate finance team could build a model projecting the company’s performance for the next five years, incorporating variables like revenue growth, capital expenditure plans, and debt repayment schedules.

- Sensitivity Analysis for Decision-Making: Sensitivity analysis is also vital in corporate finance, allowing companies to see how changes in economic conditions—such as inflation rates or currency fluctuations—impact their long-term strategies. Automating these projections in Excel ensures that reports can be updated efficiently and provide actionable insights for both internal decision-making and external reporting.

Private Equity and Venture Capital

Private equity (PE) and venture capital (VC) firms use financial models to evaluate potential investments and assess risk. Excel models are tailored to help investors analyze growth-stage companies, taking into account multiple rounds of funding, potential exit strategies, and expected returns:

- Valuation Models for Startups: In private equity and venture capital, models often account for a company’s future cash flow projections, discount rates, and terminal values to estimate its current worth. For example, in a Series B funding round, an analyst could build a model that projects revenue growth and operating costs over the next three to five years to evaluate whether the investment meets the firm’s return expectations.

- Exit Scenario Analysis: Investors use Excel to simulate potential exit scenarios (e.g., IPO, acquisition) and assess their returns under various conditions. These models enable firms to predict their ROI based on changing inputs, such as growth rates, capital structure, or market conditions.

- Sensitivity Analysis for Risk Assessment: Sensitivity analyses are crucial for understanding how shifts in key variables, like funding terms or revenue targets, impact potential returns. These insights help investors make more confident decisions and communicate the risks and rewards to their stakeholders.

Portfolio Optimization with Daloopa

When managing investment portfolios, Excel is integrated with tools like the Daloopa add-in to optimize asset allocations and improve decision-making. Daloopa enhances portfolio management by providing financial data feeds that can be directly integrated into Excel:

- Portfolio Allocation Models: Using Daloopa, portfolio managers can optimize asset allocations by adjusting for factors such as risk tolerance, market conditions, and expected returns. For example, an analyst managing a $100 million portfolio can use Excel to test different asset allocation strategies, such as increasing the weight in fixed income to reduce risk or adding high-growth tech stocks to increase potential returns.

- Real-Time Data Integration: With Daloopa, real-time market data and company fundamentals are automatically updated in Excel models, allowing for quick recalibration of asset allocations. This ensures that portfolio managers have the most current information to make data-driven decisions about rebalancing portfolios or adjusting strategies in response to market changes.

Portfolio Management

Portfolio managers leverage Excel to develop models that optimize asset allocation. With tools like the Daloopa add-in, managers can automate and streamline financial data analysis, making asset allocation more efficient. These models are designed to balance risk and return by forecasting performance under different market conditions.

For instance, a portfolio manager might build a model that evaluates how shifting from a stock-heavy portfolio to one balanced with bonds will affect returns if inflation rates rise. Using Excel’s solver function and integration with external databases, portfolio managers can fine-tune asset mixes based on real-time data, ensuring optimal performance.

If you’re looking to streamline your financial modeling and optimize your portfolio management, consider exploring Daloopa. Our Excel add-in can help automate data extraction and integrate real-time financial data, making your analysis more efficient and accurate. To learn more about how Daloopa can enhance your workflow, request a demo and see if it’s the right fit for your needs.