Asking the right questions allows you to evaluate hedge fund managers’ expertise, strategies, and alignment with your goals. Effective questioning uncovers a manager’s competitive advantages and approach to incorporating crucial elements into their ESG investment strategies.

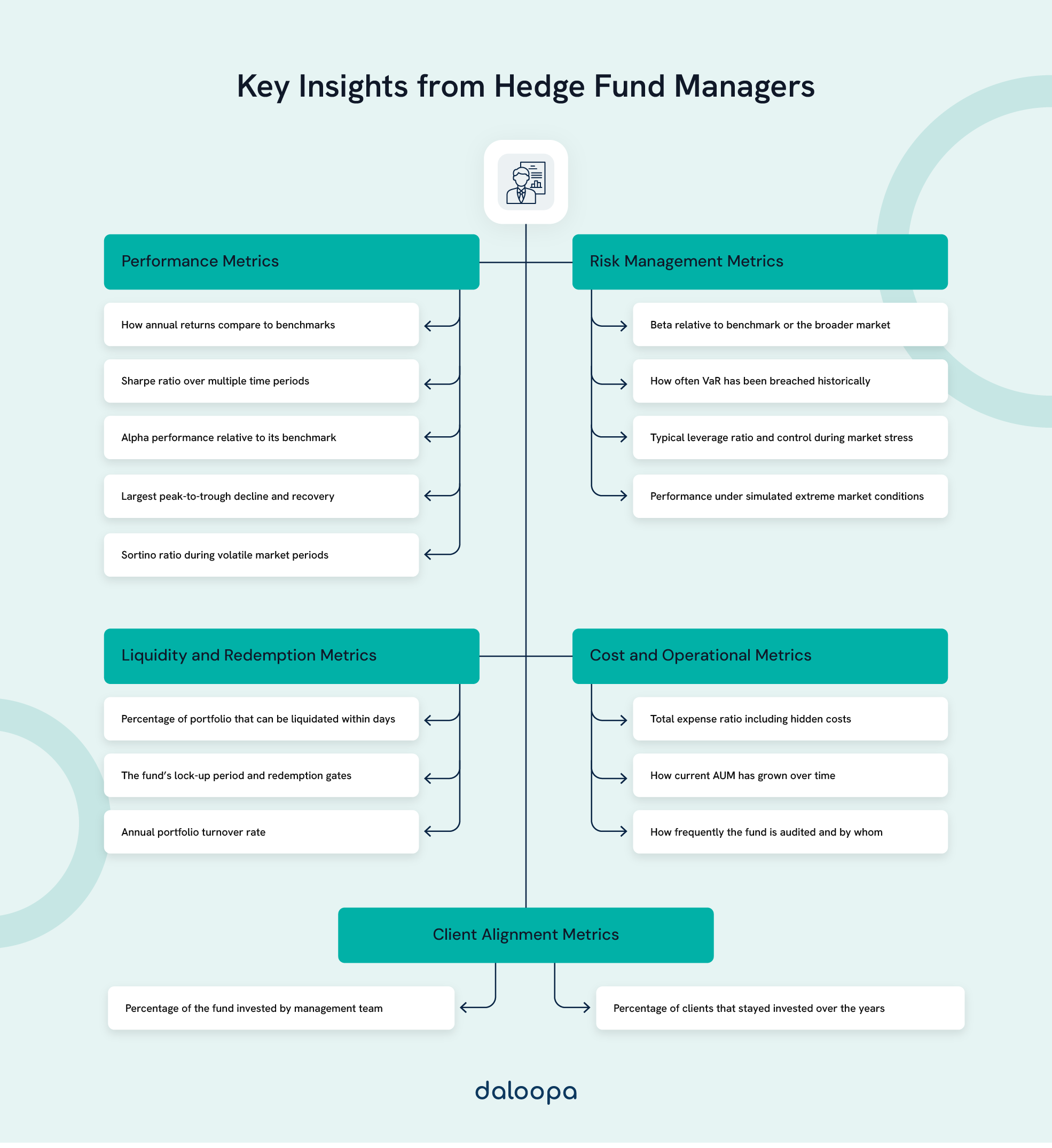

If you’re looking to ensure transparency, mitigate risks, and align investments with long-term objectives, here are the key questions to ask hedge fund managers:

1. What Is Your Investment Philosophy?

Understanding a hedge fund manager’s investment philosophy sheds light on how they generate returns and create value.

You must explore the principles guiding their strategy. Are they focused on value investing, growth opportunities, or exploiting market inefficiencies? Learning about their bottom-up analysis process and criteria for selecting securities gives you a clear view of their ESG investment strategies.

How does the manager define, measure, and mitigate risk? Do they evolve with market conditions, and can they provide examples of adaptation? Specific case studies of how their philosophy influenced a decision help you better understand their strategy in action.

Managers should also elaborate on how they balance short-term opportunities with long-term objectives. For instance, do they incorporate hedging strategies to protect gains while seeking new investments or focus on leveraging compounding growth over time? Their ability to articulate these methods reflects their experience’s depth and commitment to delivering sustainable value.

Understanding their decision-making criteria at a granular level can also reveal their adaptability. For example, how do they prioritize factors like macroeconomic trends, company fundamentals, and sector-specific insights? Managers who can synthesize these aspects seamlessly into a cohesive strategy demonstrate superior expertise.

Ultimately, you want a manager whose approach aligns with our financial goals and risk tolerance. Their philosophy should be clear, consistent, and capable of navigating complex markets effectively while adapting to unforeseen challenges.

2. How Do You Maintain a Competitive Edge?

Managers often cite unique research methods, advanced data analytics, or proprietary tools. Specialized expertise in niche markets, such as deep sector knowledge or skill with complex instruments, is another hallmark of standout managers.

Adaptability and continuous learning are vital. How do they refine strategies in response to market shifts? For example, managers who pivoted their approach during periods of significant economic change, like the 2008 financial crisis or the 2020 pandemic, demonstrate an ability to adapt and succeed in dynamic environments. Robust risk management systems and innovative team-building practices further distinguish top-tier managers.

The manager’s ability to develop and retain top talent is another aspect of their competitive advantage. Strong leadership and a collaborative culture often result in teams outperforming over the long term. Inquiring about their hiring practices and professional development programs provides insight into how they nurture expertise within their organization.

Finally, we should consider how they plan to sustain their competitive advantage over the long term. Markets evolve, and strategies that succeed today may not work tomorrow. Managers who invest in continuous education, technological advancement, and team development are more likely to remain relevant and successful.

3. What Risk Management Strategies Do You Employ?

Risk management is foundational to any investment strategy. We must understand how a hedge fund manager safeguards capital and stabilizes performance.

Key questions include their approach to leverage—how much they use, safeguards in place, and limits. Understanding their use of derivatives for hedging or speculation offers insight into the fund’s risk profile. Tools like stress tests and frequency of exposure reviews demonstrate their commitment to monitoring and controlling risks.

Stop-loss procedures and risk thresholds reveal how they handle volatility. Liquidity management strategies ensure the fund can meet redemptions during crises.

Understanding how managers navigate unforeseen risks, such as regulatory changes or black swan events, offers insight into their resilience. For example, did they adjust their portfolio during the pandemic to mitigate losses and capitalize on opportunities?

We should also ask about how they evaluate and manage concentration risk. How do they ensure that no single investment or sector disproportionately affects the overall portfolio? Managers who prioritize diversification while maintaining focus on their core strategies tend to perform better during volatile periods.

Managers who provide detailed explanations of their risk frameworks inspire confidence and demonstrate their ability to protect investments during unpredictable market conditions.

4. How Do You Integrate ESG Factors Into Your Investment Process?

Managers may systematically screen investments for ESG risks and engage with companies to address issues. For example, they might avoid industries with high carbon footprints or prioritize companies with strong labor practices. Inquiring about their use of ESG data, whether through in-house specialists or external sources, highlights their resource allocation and reliability.

Specific examples of ESG-driven decisions demonstrate how these factors influence their portfolio. For instance, has the manager divested from a company with poor governance practices, or have they engaged with a firm to encourage improvements? Their ability to balance financial performance with ESG commitments showcases their dedication to sustainable investing.

Reporting methods on ESG performance also indicate their accountability and commitment to long-term impacts. Managers who provide detailed disclosures, such as carbon emission reductions or diversity metrics within portfolio companies, signal a thoughtful approach to ESG integration.

Managers with well-embedded ESG strategies will likely align with modern investing principles and ethical goals.

5. Can You Provide Examples of Past Investment Decisions?

Learning about past decisions gives valuable insight into a manager’s strategy, adaptability, and expertise. Ask for specific examples, such as how they navigated market downturns or capitalized on unique opportunities.

For instance, a manager might describe a successful investment in emerging markets during global economic recovery or their approach to mitigating losses during significant market downturns. These examples illustrate their ability to adapt to changing conditions and execute decisions aligned with their stated philosophy.

6. How Do You Ensure Alignment with Long-Term Client Goals?

Transparency and alignment with client objectives are crucial for building trust. Ask how the manager ensures their strategies align with your long-term goals.

This could include regular updates, customized hedge fund reporting, and collaborative goal-setting sessions. Managers who actively engage with clients to refine their strategies demonstrate a commitment to accountability and mutual success.

Explore their process for managing conflicts of interest and maintaining transparency in decision-making. A manager’s ability to prioritize client needs while staying true to their investment philosophy reinforces confidence in their approach.

7. What Are the Fee Structures and Performance Metrics?

Understanding fee structures ensures alignment with your financial objectives. Ask about management and performance fees, and clarify how these fees correspond with the fund’s performance metrics.

For example, some managers may tie performance fees to high water marks, ensuring clients pay only for genuine outperformance. Others might offer tiered fee structures based on the scale of assets under management.

A transparent discussion of fees and clear explanations of how performance is measured ensure there are no surprises down the line.

Building Confidence in Your Investment Decisions

Knowing the right questions to ask hedge fund managers is key to making confident and informed investment decisions. Developing a manager scorecard can objectively evaluate hedge fund managers based on criteria like philosophy clarity, ESG investment strategies, and risk management approaches.

Asking for references and monitoring manager responses further refines our selection process. By systematically assessing managers, we make informed decisions that align with our financial goals, ensuring a solid foundation for long-term success. With due diligence, we gain clarity and peace of mind in our investments.

Need reliable tools to streamline your due diligence process? Daloopa provides financial advisors, institutional investors, and fiduciaries with up-to-date financial models and a large database, saving you time and improving your confidence immensely. Take advantage of these tools to boost your confidence and make smarter investment decisions. Give it a try today.