Artificial Intelligence is rapidly redefining the landscape of financial services, changing how institutions operate and engage with customers. AI is transforming financial services by enhancing operational efficiency and enabling more effective risk management and fraud detection. With the integration of machine learning and data analytics, financial institutions can predict trends, assess risks, and make informed decisions faster and with greater accuracy.

Incorporating AI technologies facilitates substantial advancements in areas such as regulatory compliance and data privacy. Financial firms are investing in AI to streamline operations, improve customer experiences, and detect fraudulent activities before they escalate. As these technologies evolve, they bring more sophisticated tools to manage complex financial systems.

The potential for AI to reshape financial services extends beyond operational tasks, playing a strategic role in investment advisory and future planning. As we navigate this transformation, it’s important to stay informed about how these technologies impact our financial landscape and prepare for an AI-driven future in finance.

Key Takeaways

- AI enhances risk management and operational efficiency.

- Investment in AI streamlines regulatory compliance.

- AI facilitates strategic financial planning and advisory.

AI Technologies in Financial Services

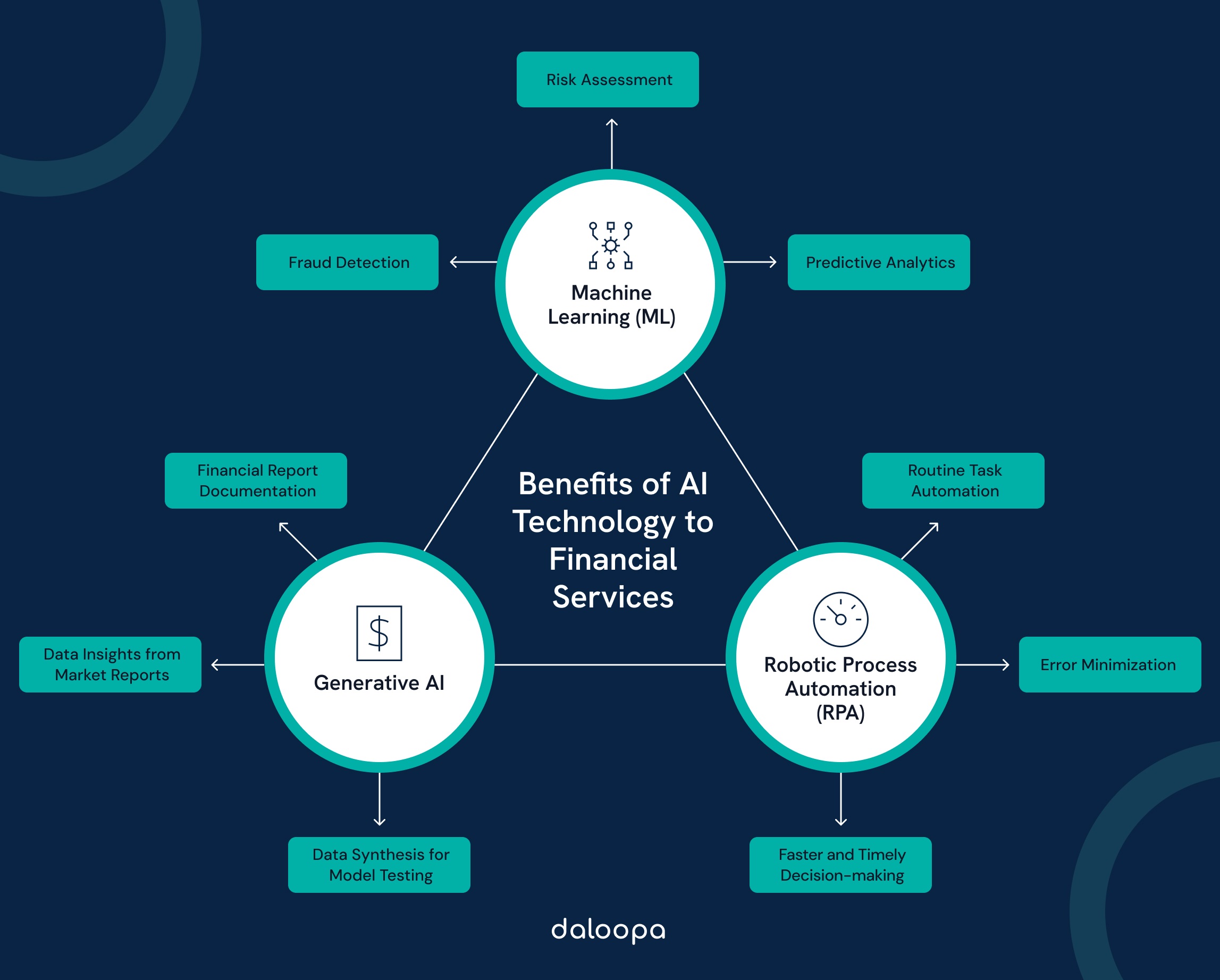

In the financial sector, artificial intelligence has paved the way for significant innovations and efficiencies. Key technologies such as machine learning, generative AI, and the automation of routine tasks are driving transformative changes, improving internal processes and customer interactions. One study found that the use of AI tools increased productivity by 14% and could increase employee retention.

While AI is promising, it is not without risks–just as with any emerging technology. For instance, AI models are trained and this means they can learn errors and biases from the data they are trained on. Generative AI is also prone to hallucinations or made-up information. The use of AI in the finance sector raises the question of data privacy and security too. Financial institutions should consider these risks and find ways to mitigate them and avoid serious implications.

Machine Learning

Machine learning is integral to the financial sector, offering powerful tools for data analysis and prediction. Banks and financial institutions use machine learning algorithms to detect fraudulent transactions, assess credit risk, and tailor personalized financial advice to customers.

By analyzing large datasets, machine learning systems continuously improve their accuracy and efficiency. This iterative learning process helps institutions make predictive financial models and forecasts, crucial in developing strategic responses to market trends.

Generative AI

Generative AI has gained momentum by providing new ways to engage customers and create financial content. Through natural language processing, it enables the automation of customer service conversations, offering quick and accurate responses without human intervention. It also assists in generating insights from unstructured data, such as market reports and customer feedback.

By creating simulations and synthetic data for testing financial models, generative AI helps enhance the robustness and reliability of institutional strategies while ensuring data privacy.

Automation of Routine Tasks

Automation of routine tasks within the financial industry significantly improves operational efficiency. Robotic process automation (RPA) is employed to handle repetitive tasks like data entry, compliance checks, and transaction processing. These technologies reduce the risk of human error, lower operational costs, and free up human resources for more complex decision-making tasks.

Additionally, the automation of back-office processes ensures faster transaction times and enhanced customer satisfaction, positioning institutions competitively in a fast-paced market environment.

Risk Management and Fraud Detection

Artificial intelligence has improved areas like credit scoring, fraud detection, predictive analytics, and anomaly detection within financial services. Effective use of AI aids in accurate risk management and swift identification of fraudulent activities.

Credit Scoring and Creditworthiness

AI significantly improves credit scoring processes by analyzing vast amounts of data that humans might overlook. Machine learning models assess numerous factors affecting creditworthiness, such as payment histories, employment records, and even social media activity.

Using AI, banks can offer personalized financial products based on detailed risk assessments. This not only streamlines the credit approval process but also helps in reducing default rates. As AI systems learn from data, they enhance predictive capabilities, making credit decisions more reliable over time. Through these innovations, institutions are able to handle credit risk with greater accuracy and efficiency.

Note that the use of alternative data like social media activity for creditworthiness is controversial. While this AI-based scoring can provide comprehensive risk assessment, there are privacy and regulatory concerns. Social media data is also complex and people don’t always portray the truth about themselves. As AI tools become more sophisticated, however, lenders will be able to make more informed decisions with fewer risks.

AI-Driven Fraud Detection Systems

AI-driven fraud detection systems employ advanced algorithms to identify patterns in transaction data that may indicate fraudulent behavior. By analyzing transaction volumes, purchase patterns, and geographic information, these systems can flag suspicious activity in real-time.

70% of financial institutions are now using AI and ML to detect and combat fraud. This includes major banks like J.P. Morgan Chase which has been using AI to analyze data and detect unusual patterns in customer behavior, such as fraudulent transactions.

This capability is crucial for banks and financial institutions aiming to minimize financial crimes. The use of AI reduces false positives, leading to more accurate detection and fewer disruptions to legitimate transactions. Additionally, AI systems continuously learn from new patterns and data, making fraud detection more robust and adaptive. For financial services, leveraging AI in this way is essential for maintaining trust and ensuring security.

Predictive Analytics

Predictive analytics plays a pivotal role in risk management by forecasting future trends based on historical data. AI enhances these capabilities by processing massive datasets quickly and efficiently, thereby making predictions more accurate and actionable.

In financial services, predictive analytics is essential for anticipating market shifts, credit defaults, and customer behaviors. These insights enable companies to make informed decisions that mitigate potential risks. By integrating AI, organizations can develop dynamic models that adjust to new information, increasing the precision of risk assessments and providing a competitive edge in the industry.

Anomaly Detection

Anomaly detection is a critical aspect of identifying irregularities that might indicate violations or fraud. AI systems excel at this by evaluating vast datasets to find deviations from expected patterns.

Through techniques such as clustering and neural networks, AI identifies outliers that might signify fraud or other risks in real time. This rapid detection allows financial institutions to respond swiftly, preventing potential financial loss and reputational damage. AI-driven anomaly detection is vital for maintaining integrity and security across financial operations. It provides organizations with the agility to address issues as they arise, ensuring optimal risk management practices.

Operational Excellence Through AI

Artificial Intelligence plays an important role in enhancing operational excellence within the financial services sector. By automating tasks and implementing robotic process automation, businesses can significantly improve efficiency and productivity.

Boosting Efficiency and Productivity

AI can significantly revolutionize how financial services operate by optimizing efficiency and productivity. Through intricate data analysis and predictive modeling, AI systems allow us to make more informed decisions promptly. These systems can process complex datasets much faster and more accurately than traditional methods, minimizing human errors and increasing speed.

In one study conducted on mid-level professionals, generative AI increased output quality by 18% and reduced time taken to complete tasks by 40%.

Additionally, AI-driven analytics help identify patterns and trends, which can lead to proactive measures and innovative solutions. By automating repetitive tasks, we can focus on more strategic activities, further enhancing our capabilities and service delivery.

Robotic Process Automation in Finance

Robotic Process Automation (RPA) is a critical component of achieving operational excellence. By integrating RPA in finance, we automate routine tasks like transaction processing, compliance checks, and reporting. This reduces the potential for human error and accelerates task completion rates.

RPA tools can work around the clock, increasing the available service hours and improving customer satisfaction. As we leverage RPA, workflows become more streamlined, and operational costs decline. This tool not only enhances our efficiency but also improves the accuracy of our processes, providing a strong foundation for sustainable growth in financial services.

According to a survey by Deloitte, some sectors have seen a 59% cost reduction and a 90% increase in quality with RPA. The downside comes with scaling RPA as most organizations find it harder than expected with only 3% having managed to achieve this.

AI in Regulatory Compliance and Data Privacy

AI is redefining how financial institutions approach regulatory compliance and data privacy. By leveraging AI systems, these organizations are enhancing compliance processes, managing risks more effectively, and safeguarding personal data with precision.

Ensuring Compliance Efficiently

AI technologies play a vital role in streamlining compliance efforts. Financial institutions often face complex regulatory environments that require meticulous adherence. AI solutions automatically monitor transactions, detect anomalies, and ensure compliance with regulations like the Sarbanes-Oxley Act.

One good example is the use of AI by financial institutions to improve AML compliance. AI models can detect patterns that manual processes might miss which may indicate potential money laundering.

These systems are capable of processing vast amounts of data in real-time, reducing the risk of human error and improving accuracy in compliance activities. The use of AI-driven tools aids firms in adhering to ever-changing regulations, thus minimizing legal risks and enhancing operational efficiency.

AI for Data Protection

In the realm of data privacy, AI offers robust solutions for protecting sensitive financial information. With regulations such as GDPR and CCPA, institutions are required to implement stringent data privacy measures. AI helps in identifying vulnerabilities in data protection systems and automating responses to potential breaches.

Our focus is also on ethical AI use, ensuring these technologies respect user privacy while delivering their benefits. AI models can be trained to anonymize data and generate alerts when privacy is threatened, creating a proactive defense strategy against breaches.

Strategic Investment and Financial Advisory

The integration of AI in finance is enhancing investment strategies and transforming financial advisory services. This leap forward leverages technologies like machine learning and generative AI, redefining how we approach portfolio management and client interactions.

AI-Powered Investment Strategies

AI has become a cornerstone in optimizing investment strategies. By employing machine learning algorithms, we can analyze vast sets of data to identify trends and make informed decisions. This approach improves accuracy in risk assessments and portfolio management.

Generative AI helps in scenario analysis, forecasting potential market behaviors. It allows us to predict stock movements and assess various market conditions. This data-driven approach helps fine-tune investment strategies, making them more responsive to real-time market dynamics.

More importantly, AI enhances our ability to personalize investment plans based on client profiles. By analyzing historical data and current financial environments, we cater more effectively to individual investor needs and goals.

Transforming Financial Advisory Services

AI is reshaping financial advisory by automating routine tasks and providing deeper analytical insights. This enables us to focus on strategic client interactions and long-term relationship building.

Tools powered by machine learning can generate tailored financial advice quickly. These systems assess client goals and risk tolerance, offering recommendations that align with their financial objectives. Additionally, AI platforms enable continuous portfolio monitoring and adjustment, keeping us proactive in managing client assets.

Betterment, for instance, is a robo-advisor that uses AI to create personalized investment portfolios for its clients. By considering individual risk tolerance and financial goals, Betterment provides accessible and affordable investment services for individuals and advisors.

We also leverage AI for compliance and risk management, minimizing errors in documentation and reporting. By streamlining these processes, we improve efficiency and client satisfaction in our advisory services.

Looking Ahead: The Future of AI in Finance

As we examine the role of AI in finance, several critical aspects emerge, including ongoing market trends, potential innovations, and the necessary regulatory adjustments. These elements are essential for understanding how AI will continue to shape the financial landscape.

AI Adoption and Market Trends

AI technologies are increasingly integrated into financial services, enhancing efficiency and decision-making. Many financial institutions are harnessing AI to improve customer interactions and optimize back-office processes. A notable trend is the use of AI-powered virtual assistants, which streamline customer service and provide personalized financial advice.

Investment in AI is also growing, with financial firms allocating substantial budgets for AI development. As AI adoption accelerates, we see a focus on improving data analytics to drive better insights and outcomes. These trends will likely continue as firms seek to gain a competitive edge.

Predictions and Innovations

The future of AI in finance is promising, with new innovations on the horizon. We anticipate advancements in predictive analytics, enabling more accurate risk assessments and investment strategies. AI may also revolutionize fraud detection by identifying anomalies in real time, reducing financial crime.

Additionally, innovations in blockchain technology, combined with AI, could transform transaction processing, making it faster and more secure. These predictions highlight the potential of AI to redefine how financial services operate, offering enhanced returns on investment for early adopters.

Preparing for Regulatory Adjustments

As AI transforms finance, regulatory frameworks must evolve to address new challenges. Authorities may need to develop guidelines on data privacy and ethical AI use, ensuring consumer protection. It’s crucial for financial institutions to stay proactive about compliance with emerging regulations.

An important aspect is understanding how AI can align with existing legal standards while innovating within those boundaries. Preparing for potential regulatory adjustments will help firms navigate the evolving landscape, minimizing risks associated with non-compliance.

Improved Efficiency and Accuracy with AI-Powered Financial Services

The impact of AI in financial services is undeniable. As it continues to evolve, its potential to reshape risk management, fraud detection, and strategic decision-making grows. This makes it an indispensable tool for institutions navigating the complexities of modern finance. However, with these advancements come challenges, such as mitigating biases in AI models and ensuring data privacy. As financial firms continue to invest in AI technologies, they must balance innovation with responsibility, shaping a future where AI enhances financial security, accuracy, and customer trust.

Spend less time on manual tasks and boost productivity by using Daloopa’s AI-powered platform. It provides accurate, up-to-date financial data that automatically updates your models quickly and accurately. Focus on insights and strategy, while Daloopa takes care of the rest.